Service for searching

arbitration

A trader supplying an arbitrage strategy – arbitrageur – buys an active from one stock and sells it to another at a higher price. Arbitrage has been existing for long and proved itself the most reliable strategy for earning on classic stock and currency markets. Now the great number of crypto currency and stocks puts arbitrage on a different level of dynamics and earning opportunities for private investors. Our service offers you a unique opportunity to take advantage of this situation on the market.

trades

at cryptocurrency market

+ screener for Intra-exchange arbitrage deals

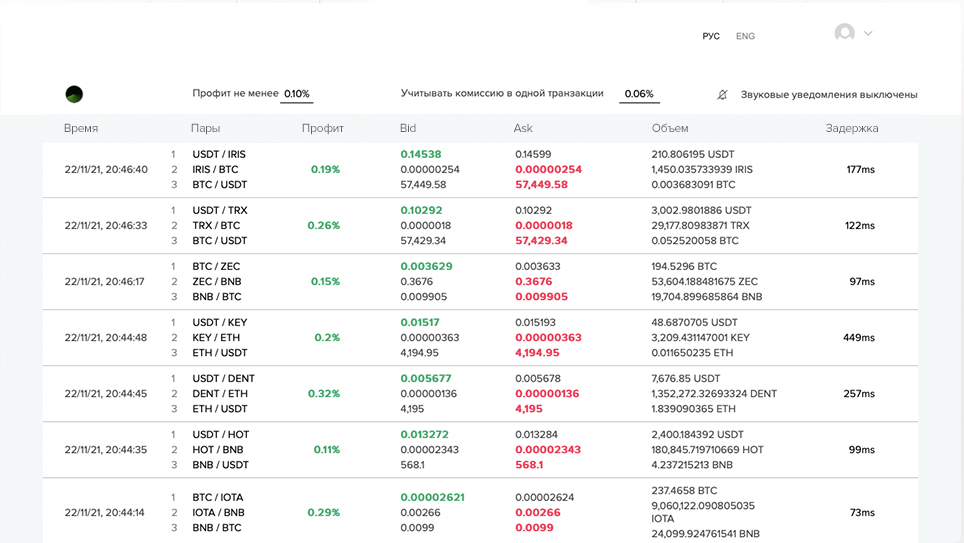

- Setting up exchanges directly in the bot: Binance, Bybit, Bittrex, Hitbtc, Poloniex, KuCoin, Gate.io, OKX, Huobi, Exmo

- Filters by profit size and maximum amount in trades

- The receipt of arbitration trades in your Telegram with a delay of only 2 seconds

- The ability to engage in arbitration from a mobile device

- A convenient guide to arbitrage trading directly in the bot

- Easy connection to the bot in your personal account on the site after subscribing

- Available on all tariff plans starting from the “Beginner" tariff

10 reasons why Arby will help you earn money

Guaranteed income

It doesn’t matter if market goes up or down you can always gain with arbitrage deals

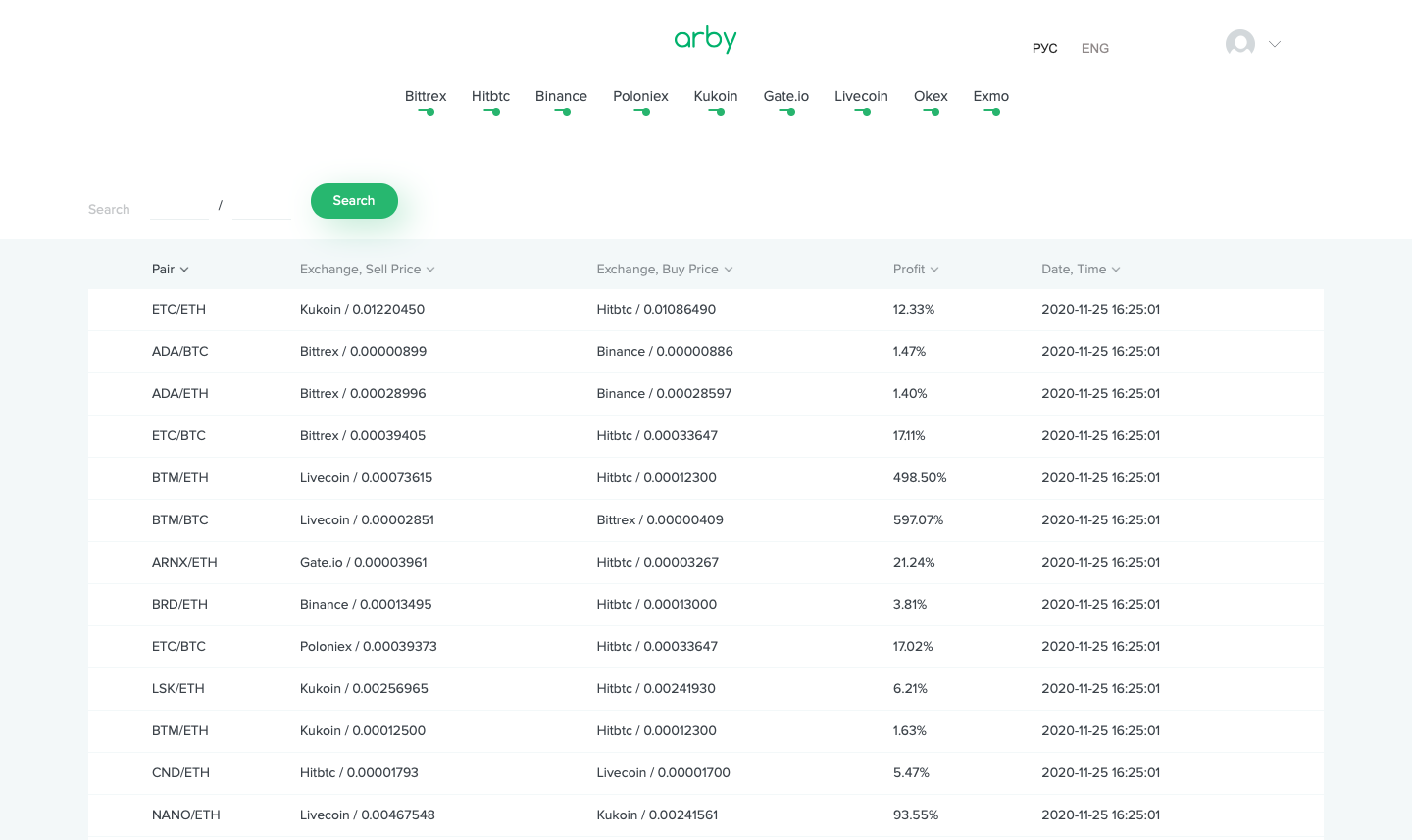

The major stocks

We collect data from largest exchanges and provide live information with just a 30 seconds delay.

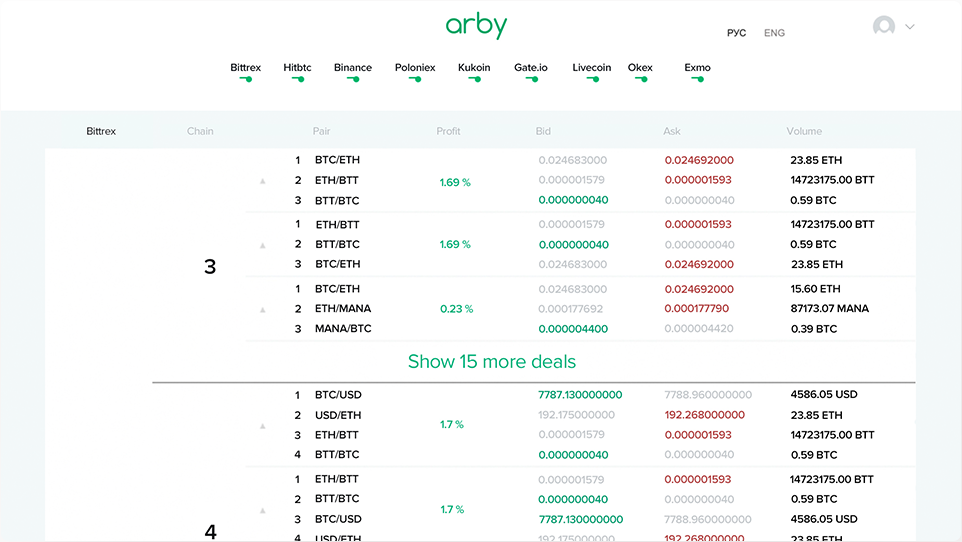

3 calculation algorithms

The service is adjusted to the most quick arbitrage algorithm by default settings. Also, two more algorithms are available.

Quick result

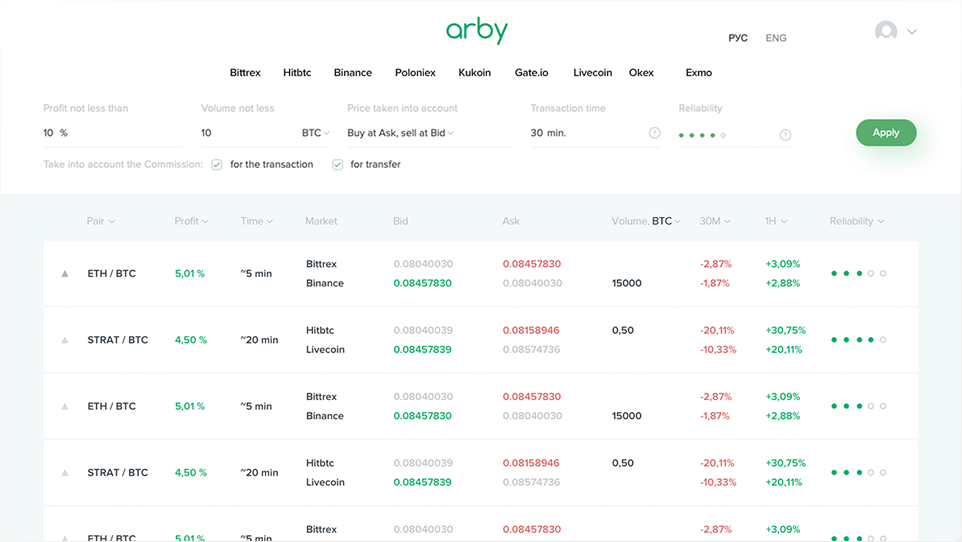

Every 30 seconds the service gives about 10 inter-exchange arbitrage pairs

Transfer timing

On every arbitrage pair the service shows the potential time of actives’ transfers from one stock to another

Price change

For each pair the price change is displayed for half an hour and an hour. This helps to understand the stock exchange climate at the moment.

Reliability evaluation

The service evaluates the market situation and other various factors to help you in choosing the most profitable and reliable deal

Convenient filters

With the help of filters you may tune any settings, enable/disable stock exchanges so that you can find deals tailored to your tasks

Equal loading distribution

With a large number of users online, we distribute stocks and arbitrage pairs keeping a possibility for arbitrage for everyone.

Intra-exchange arbitrage

Ability to make arbitrage transactions in one exchange

Arby indicators on TradingView

Plans

*Number of subscriptions is limited

?

This is a necessary measure to preserve the possibility of arbitration for everyone.

The cost of a subscription can be rewarded within a few hours

How it works?

Our partners

Payment systems

Follow our news on Telegram

Latest news, useful tips and strategies.

Subscribe to our channel

Clear tips, lessons, and subtle techniques.