ABOUT

The service has been working since 2018 and for the entire time of its existence it has noticeably grown with new features, products and regular users. Having started as an arbitrage service, today Arby is already a group of products whose common goal is only one thing – to help traders earn more and more efficiently on the cryptocurrency market. Below we will tell a little more about each of them, but this is not all that we are working on and are going to implement in the future.

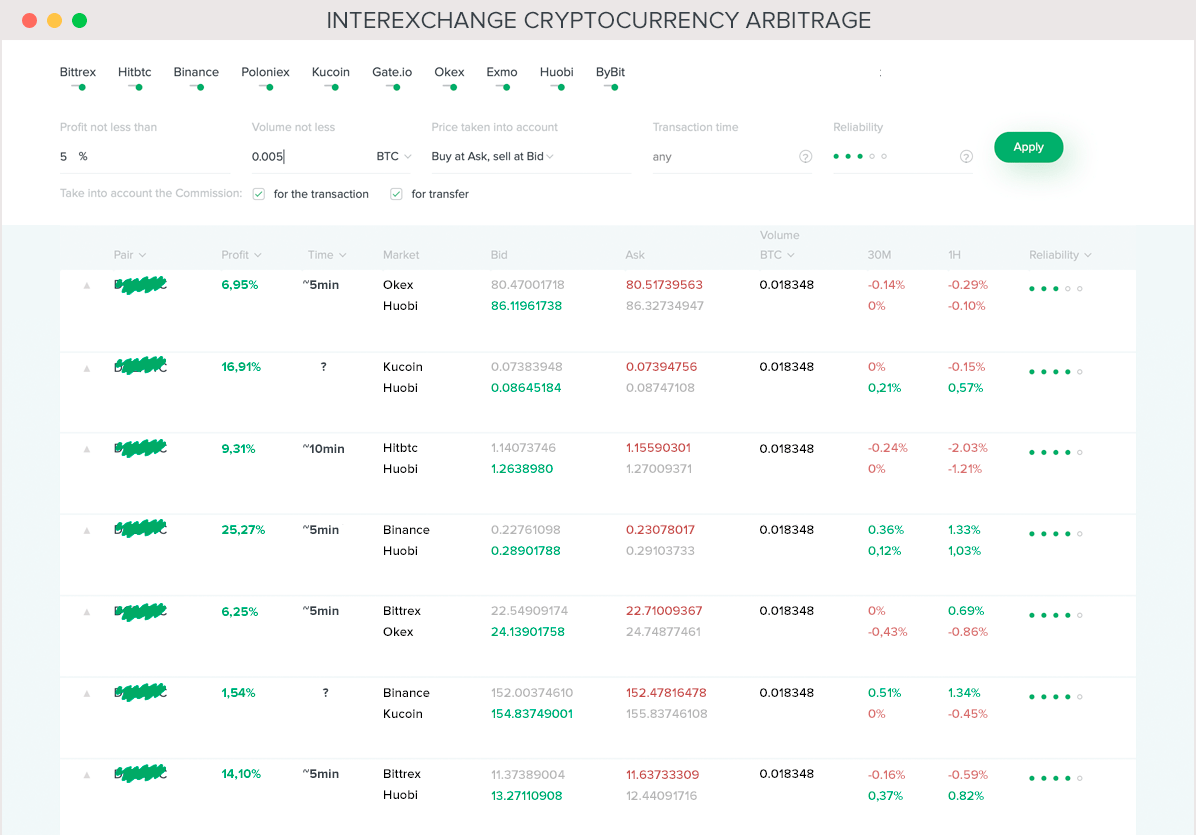

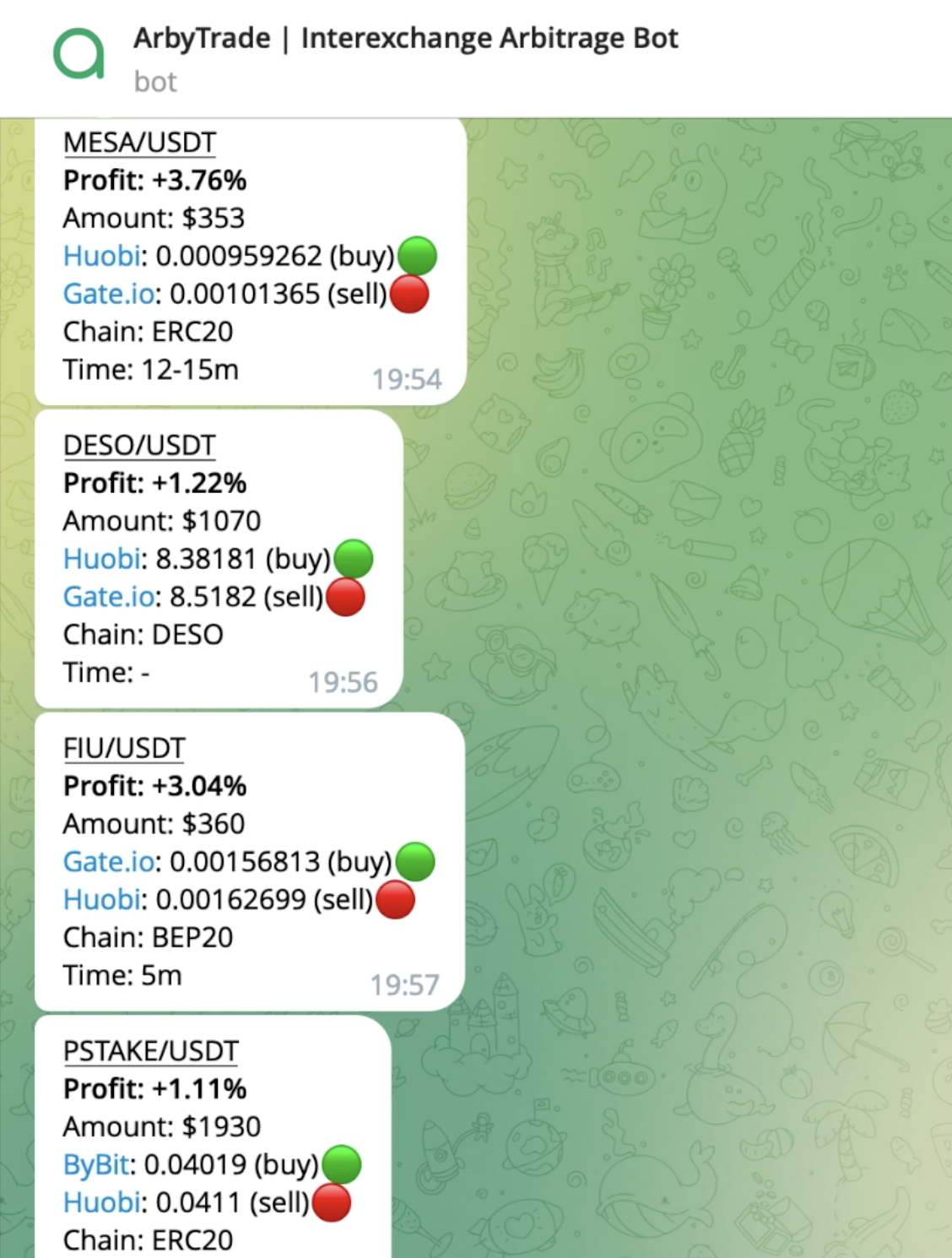

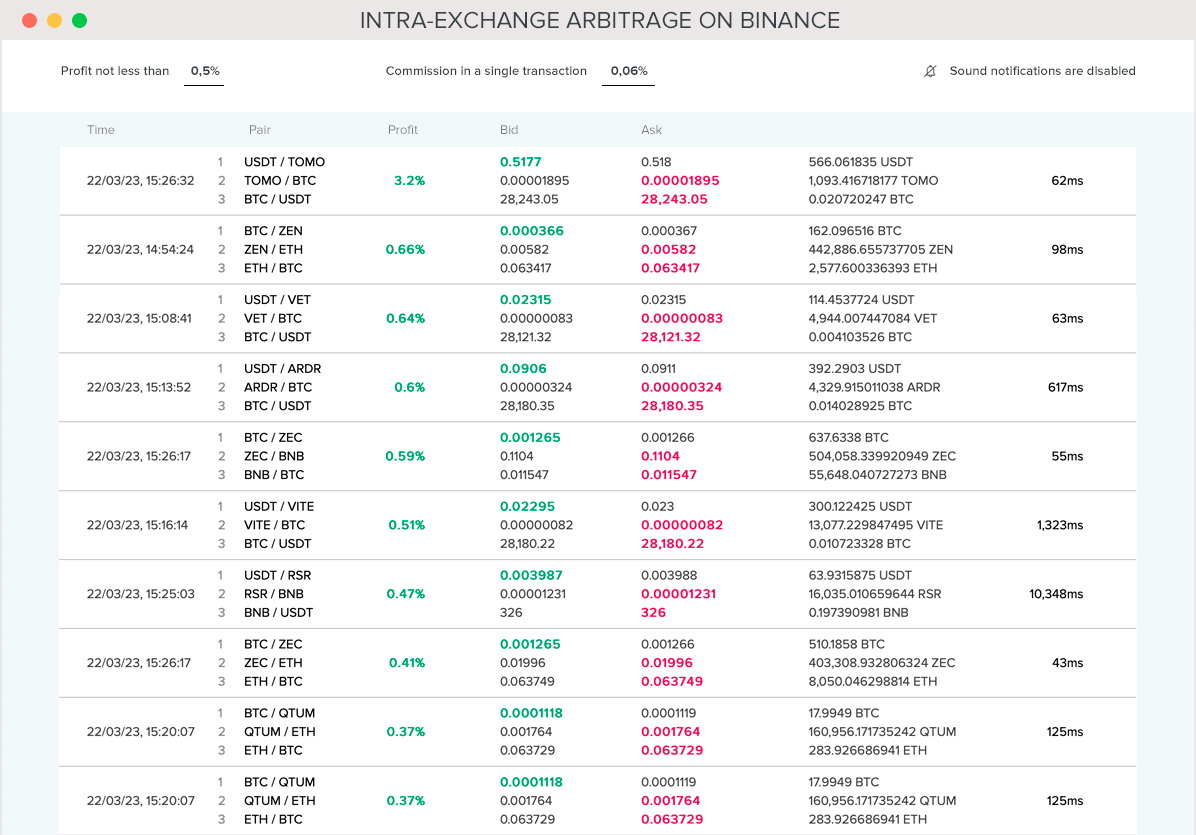

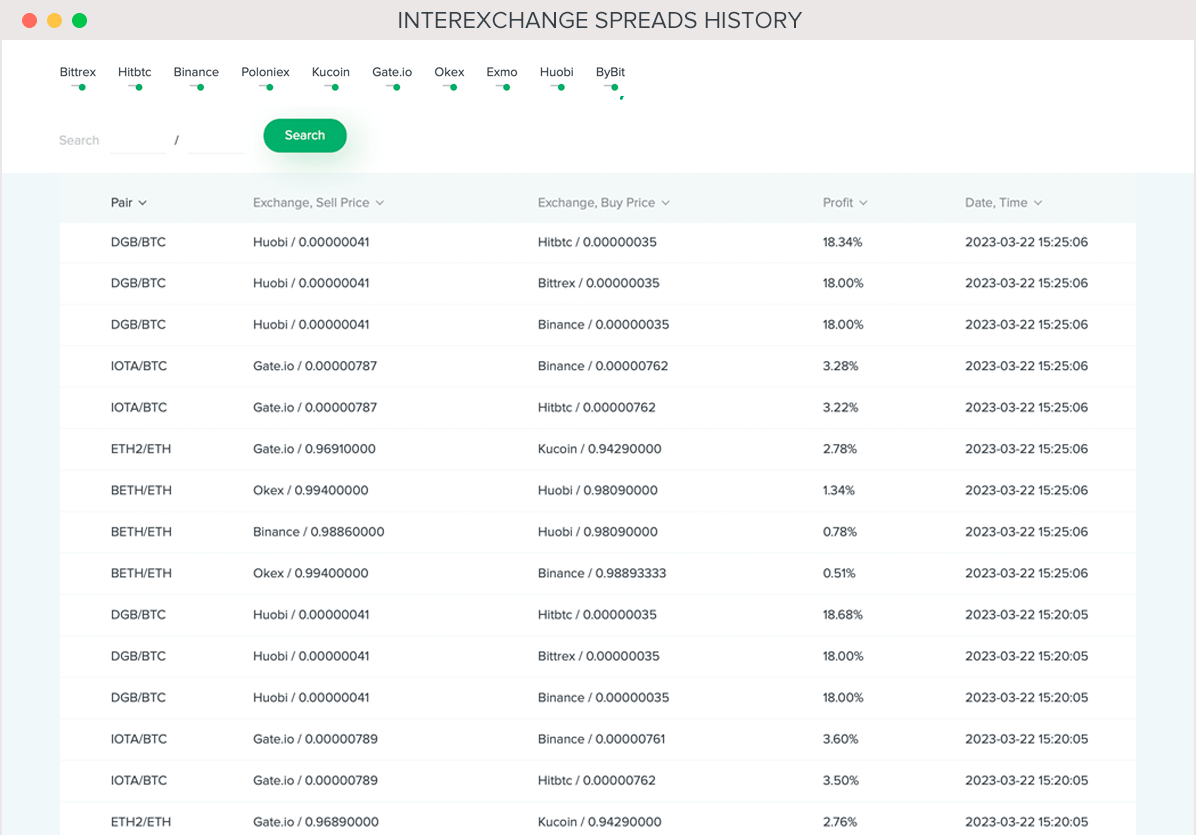

ARBITRATION SCREENERS

The Arby arbitrage screener has a number of features that have no analogues on the market:

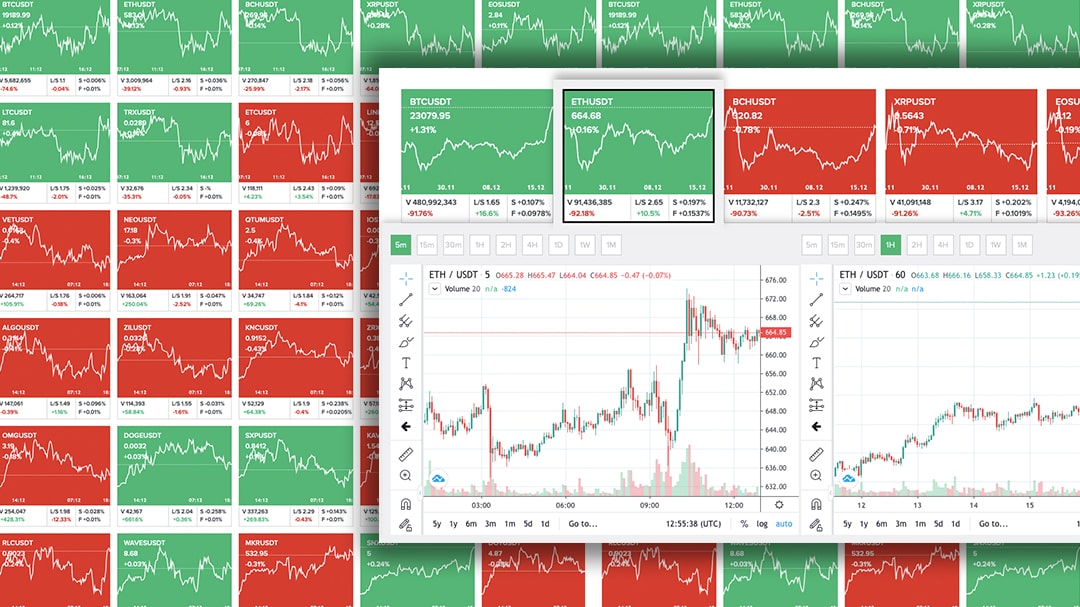

INDICATOR SCREENER OF BINANCE FUTURES EXCHANGE

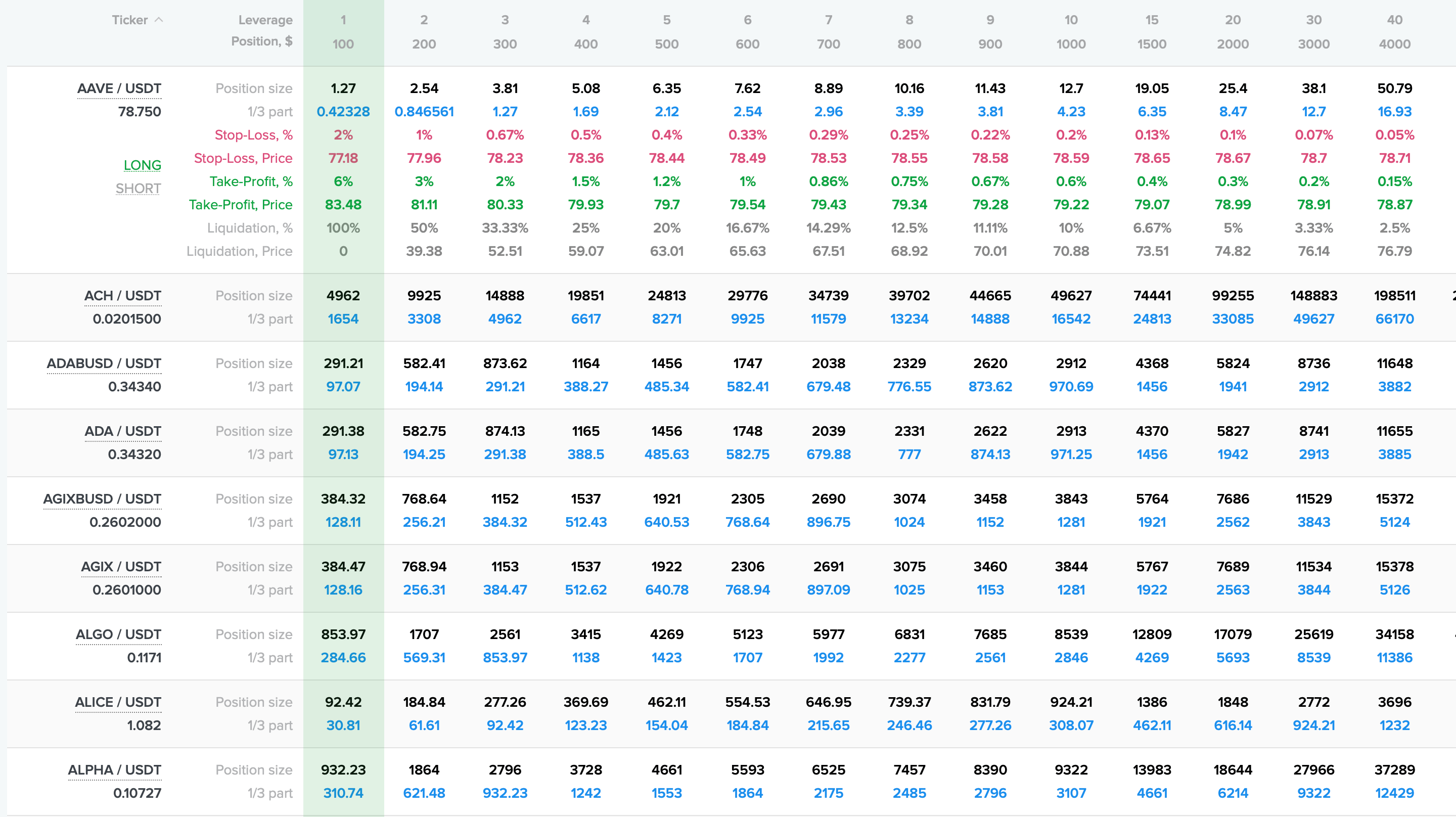

RISK CALCULATOR FOR BINANCE FUTURES EXCHANGE

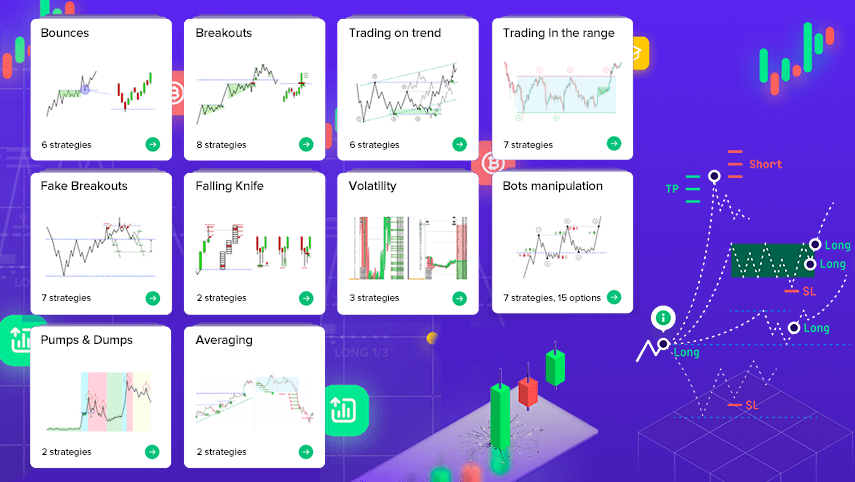

ENCYCLOPEDIA OF TRADING

Over the years of the service's existence, copies of our website with a completely copied design and the most similar names and domain names have periodically appeared on the network. At various times, some of these “copies” also offered to buy a subscription, some were financial pyramids, HYIPs that collected funds from users and after a while simply disappeared.

THE ARBY TRADE COMPANY AND ITS SERVICES HAVE NEVER TAKEN, DOES NOT TAKE AND WILL NOT TAKE USER FUNDS INTO MANAGEMENT, AND IS NOT RELATED TO SUCH FRAUDULENT SCHEMES. ALL PRODUCTS OF THE SERVICE ARE ON THE DOMAIN NAME – HTTPS://ARBY.TRADE. ALL EMAILS COMING FROM US COME ONLY FROM ADDRESSES MAILBOX@ARBY.TRADE or SUPPORT@ARBY.TRADE. AND WE DON'T WRITE PRIVATE MESSAGES IN TELEGRAM.

Be careful and check the address of the service website when you click on the links leading to our site.