– the heart of perpetual cryptocurrency futures.

Cryptocurrency exchanges, especially those offering perpetual futures trading, use funding as a key tool that helps maintain a balance between the price of perpetual futures and the price of the underlying asset on the spot market. In this article, we will analyze in detail what it is, why it is needed, how it works and how you can make money from it.

WHAT IS FUNDING?

Funding rate is periodic payments exchanged by traders holding open positions in perpetual futures. These rates can be either positive or negative, and their purpose is to keep the price of the futures contract as close as possible to the price of the asset on the spot market.

To begin with, let’s look at what the spot market is, the futures market, and what is the key difference between classic futures and perpetual cryptocurrencies.

Spot market:

- This is a market where assets (e.g. BTC, ETH) are bought and sold with immediate delivery. That is, you pay the money and immediately receive the cryptocurrency to your wallet.

- The price is determined by supply and demand in real time.

- By purchasing an asset (BTC) on the spot market, you own a real asset that you can withdraw, sell, exchange, donate, etc.

Futures market:

- This is a derivatives market where traders enter into contracts to buy or sell an asset in the future at a pre-determined price. (this is the definition of classical futures).

- When “buying” futures (opening a long position), there is no purchase of the asset itself, cryptocurrencies (BTC or ETH), but rather, a bet is placed on price growth; when “selling” (opening a short position), a bet is placed that the price will fall.

- You do not own an asset, but speculate on its price using leverage. You cannot withdraw futures from the exchange, change them for something else, or give them as gifts. By the way, even 1 leverage (securing a deal is equal to the position volume) this is still a “loan” taken from the exchange, since by opening, for example, a short position, you are “selling” something that you do not own (to be more precise, the exchange allows you to bet on a decrease).

Classic and perpetual cryptocurrency futures market. What’s the difference?

The most important nuance is the difference between the classic futures market and the perpetual cryptocurrency market – this is where the nature of the funding mechanism lies.

Futures on the classical market (for example, CME) They have an expiration date — this is a pre-determined moment when a futures contract expires (usually at the end of a month, quarter, or year). On this day, the contract is either executed (the underlying asset, such as oil or gold, is delivered to the buyer), or the payment is made in money without physical delivery.

For example, you bought Bitcoin futures with expiration on March 31, 2025. On this day the contract closes, and you either make a profit/loss depending on the price, or the Bitcoin itself.

In the classic futures market, funding is not required because futures prices naturally converge to spot prices by the expiration date. This is mainly due to arbitrage mechanisms: if the futures price deviates significantly from the spot price, traders can buy an asset on the spot market and sell (short) the futures, locking in a risk-free profit when prices converge by the expiration date. Also, contracts are completed either by the delivery of an asset or by monetary settlement, which also ties them to the real value.

There is no expiration date in perpetual cryptocurrency futures, and without funding, prices could endlessly deviate from spot prices in any direction, and without it, the market would become uncontrollable:

- Speculative bubbles: Traders could endlessly drive futures prices up (or down) using leverage without being tied to the real value of the asset. Futures prices could fly into “space” (for example, $100,000 for OTC futures at a spot price of $50,000) or collapse to abnormally low values.

- Position imbalance: Without funding, traders would continue to open long positions in a bull market or short positions in a bear market, increasing unilateral pressure on the price.

- Liquidity collapse: Market participants would lose interest in futures, as their price would not reflect reality, and arbitrage would become impossible without a peg.

- Systemic risks: Exchanges could face massive liquidations and losses, which would destabilize the entire cryptocurrency market.

ACCRUAL/DEBITING OF FUNDING

Through funding, exchanges encourage traders to open futures positions in the opposite direction from the current imbalance between spot and futures.

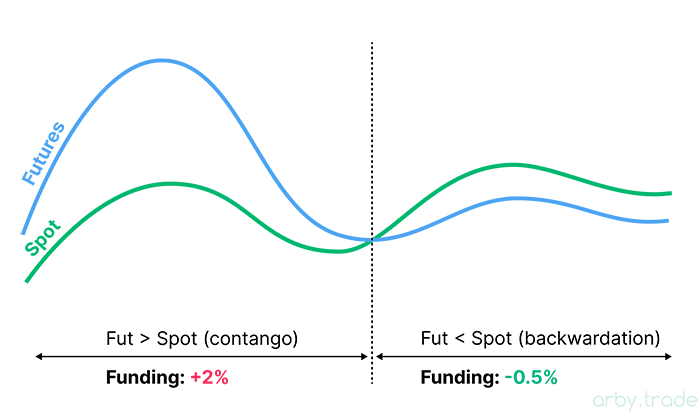

For example, if the futures price has moved too far up from the spot price (this is called contango; many long positions are open), then the exchange should encourage traders to close long positions and open shorts. To do this, the exchange sets a positive rate, and at the time of settlement, long traders are charged funding, and short traders, on the contrary, are paid.

When the futures price, on the contrary, is lower than the spot price (backwardation; too many open shorts), the exchange sets a negative rate, thereby stimulating the opening of long positions and the closing of shorts. In this case, the funding is paid to traders with longs, and deducted from traders with shorts.

CALCULATION OF THE FUNDING RATE

The funding rate for a particular futures is calculated by the exchange based on the difference between the perpetual futures price and the spot price. The formula usually includes the spot price index (the average price of an asset on the spot market), the futures price, and an additional coefficient that is sometimes added to account for the “cost of capital.”

The calculation formula for accrual/debiting to a specific trader looks like this:

Amount of funding = Position size × Funding rate

Example: if the funding is -1.50% and you have a long position open for $10,000 you will be paid $150 at the time of the calculation of the funding. If the funding is +1.50% and you are still in longs, then on the contrary you will be charged $150. For short trades the opposite is true — in the first case the trader will pay the funding and in the second case he will earn.

It is important to keep in mind that the accrual/debiting is calculated not from the amount secured by the position or the amount on deposit with the trader, but from the actual volume of the open position. If you have $100 and you have opened a position with x10 leverage, then funding will be calculated from $1000.

THE MOMENT OF THE FUNDING CALCULATION: HOW AND WHEN DOES THIS HAPPEN?

On most cryptocurrency exchanges (Binance, Bybit, OKX and others), funding is calculated every 8 hours, 3 times a day according to the standard schedule: 00:00, 08:00, 16:00 UTC. The 8-hour interval accepted by exchanges is a compromise between the accuracy of adjustment and convenience for traders (not realtime, but not daily calculation either).

The calculation (accrual/debiting) takes place instantly at the specified time and is based on a snapshot of your position at the time of this time. This means that the exchange records your open position and applies the current funding rate.

For example, on the MEXC exchange, TRUMP futures have -1% funding with a calculation time of 00:00 UTC. Then, if you have a long TRUMP open for $10,000, then at 00:00 you will be charged $100.

In order for funding to be taken into account, your position must be open before funding time and remain open at the time of the snapshot. If you close a position even a second before 00:00 UTC, you will not be credited or charged for this period.

- Minimum retention time: The position must be active at least at the funding time. Even if you opened it a few seconds before 00:00 UTC and the position is active at the funding time, funding will be applied.

- Period of validity: Funding is calculated for the previous 8-hour period, but the payment/debit itself depends on whether you have a position at the time of the “snapshot”.

The calculation is strictly tied to the moment. If you did not hold a position at the funding time, the exchange will not “catch up” with you later and charge/deduct funding for previous periods. However, there is a caveat:

- Delays in the display: Sometimes, due to the high load on the exchange or technical failures, the amount of funding payout may be displayed in your balance with a slight delay (for example, a few minutes after 00:00). But the calculation itself still takes place exactly at the specified time.

- Next Funding Rate: The exchange usually shows the predicted funding rate a few hours before settlement. It can change until the last moment, and the final rate is fixed only at the time of the snapshot.

ABNORMAL FUNDINGS

The above is the basis of what determines and how the funding mechanism works. However, there are regular situations when funding is not 0.01–0.5%, but 2-3%, and is charged not 3 times a day, but every 4 hours, and sometimes even every hour (!).

As a rule, such deviations from the norm occur on highly volatile coins, at times of listings, drops, and other activity of the project behind the coin. Excessive hype creates excessive activity and price fluctuations, which exchanges must control. At such times, the exchange deviates from the basic setting and increases the intensity of its market stimulation, increasing the size of the bet and paying / debiting it more often than usual.

Such situations provide excellent opportunities to practice various strategies based on making money from funding.

PATTERNS AND INEFFICIENCIES OF THE MARKET ARISING FROM FUNDING

Considering all of the above, we can conclude that some time before the calculation of the funding, at the time of the calculation, and after, these are the moments when price fluctuations can be caused solely by an increased funding rate. The higher the absolute value of the rate (it does not matter whether it is positive or negative), the greater the effect on price fluctuations.

Traders with open positions, from which funding will be debiting, will strive to close them before the estimated time. Other traders, seeing an increased rate, may, on the contrary, start opening positions in the accrual direction (with a negative rate, open a long, and with a positive rate, open a short) in order to receive a funding payout. This creates a prerequisite for a price change in the direction of the upcoming charge before the settlement.

Traders who opened their positions in anticipation of the funding accrual, including arbitrageurs, will close their positions immediately after funding time, as their goal was to receive a funding payout. This creates a prerequisite for a reverse price movement immediately after the estimated time. For example, if the rate was negative, some traders opened long positions. That will be closed immediately after the estimated time, which would create short pressure on the price after the funding was credited.

In addition, those traders who decided to avoid debiting funding from their open positions and decided to close them before the estimated time, after a couple of seconds / minutes after the funding time, they can reopen their positions in the same direction. For example, with a negative rate, shortists close their shorts before the funding time to avoid debiting, sit out the settlement moment without a position, and open the short again the next second/minute after funding. This also creates a prerequisite for a short price movement immediately after accrual (in the case of a negative rate).

As a result, price movements occur in the market near the funding time, which can be predicted with a sufficient degree of accuracy. But again, this only matters if the rate is big (1% or more).

Knowing such patterns, it is possible to trade off various strategies based solely on funding.

TRADING STRATEGIES BASED ON FUNDING:

1. One way strategies:

Opening a trade before funding

Core: Earnings on the accrual of funding.

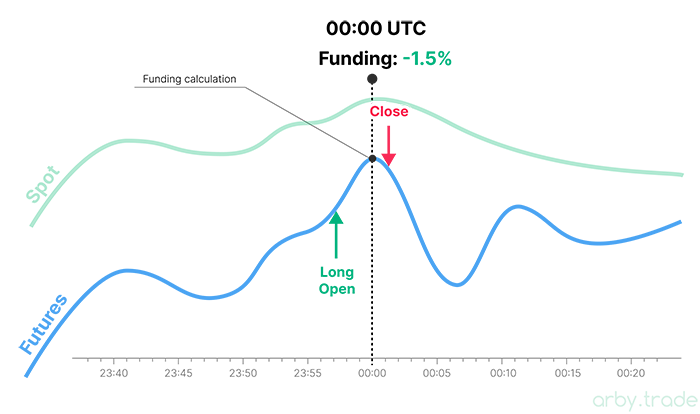

Execution: Opening a position in the direction of the upcoming funding accrual one second/minute before the funding time and exiting the position immediately after funding. For example, with a negative rate, this means opening a long position a few seconds before the funding time and closing this long immediately after funding.

Opening position after funding

Core: Earnings on impulse movement immediately after the funding.

Execution: Opening a position immediately after the funding time in the direction opposite to accrual and exiting the position after momentum.

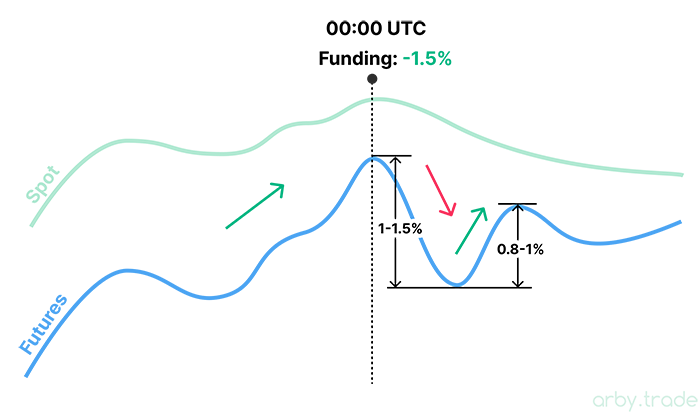

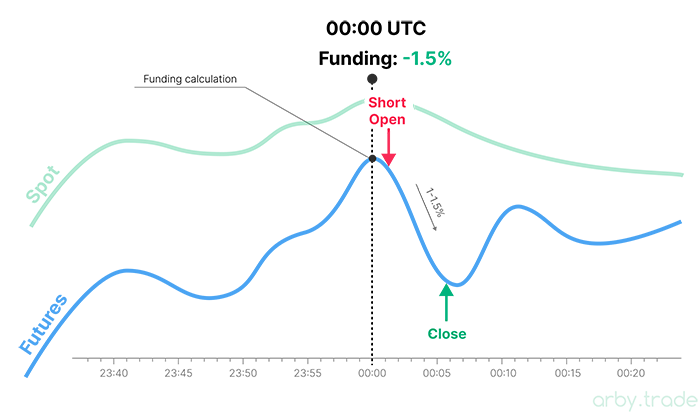

For example, with a negative rate (accrual to longs) this means entering a short immediately after the funding (those who were in long positions and wanted to earning funding are now closing their positions, so we expect a short movement in the first seconds/minutes after funding) and closing this short at the end of the pulse at the close of the first impulse candle. As a rule, the magnitude of this pulse is equal to the amount of funding that was before this pulse. If the rate was -1.5%, then after funding, we can expect a short movement in the range 1-1.5% below the price level preceding the funding.

Opening after the pulse

Core: Earning on a pullback movement after the first impulse.

Execution: After the funding is credited, an impulse occurs, as described in the previous strategy. Opening a position after this impulse, in the direction of the previous funding accrual.

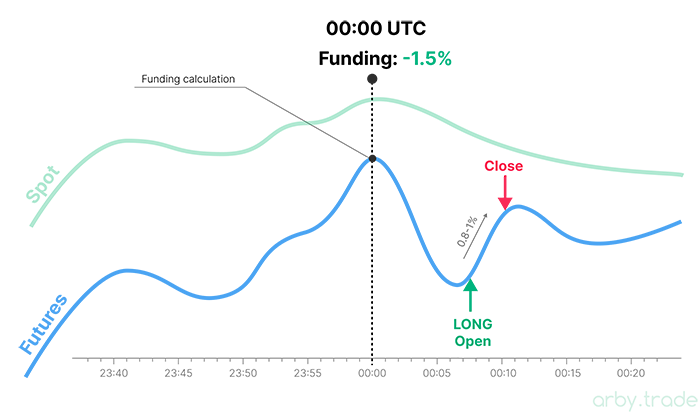

For example, with a negative rate, after the longs have been funded, after which the first impulse to short has occurred, this means entering the long at the end of this impulse. The position is closed when the price rolls back close to the previous value of the funding. At the rate of -1.5%, after funding time, the price drops by 1-1.5%, there is a long open, followed by the closing of the position when the price has grown back by 0.8-1 %.

2. Arbitrage Strategies:

The strategy of intra-exchange arbitrage funding

Core: Funding earnings using multidirectional positions on spot and futures.

Execution:

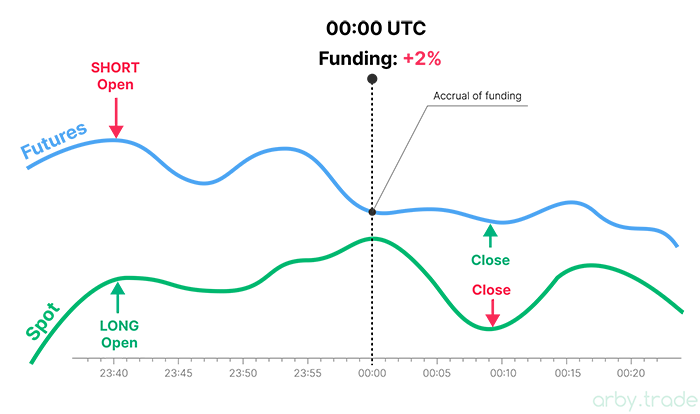

- With a positive rate: purchase of an asset on the spot market and open short on futures with the same volume.

- With positive rate (traders with long positions pay to traders with shorts) you earn money from short position funding. Regardless of the price movement this position is hedged by the spot position: if the price goes up the futures loss will be offset by the spot profit; if down the spot loss will be offset by the futures profit. But at the funding time your futures position in any case receives a profit from the payment of the funding.

- If the rate is negative you can do the opposite: “short” on the spot (you can borrow a coin from the exchange in the margin trading section and sell it) and open long on futures. Positions hedge each other and at the funding time rate is accrued for a long position on futures.

- If the funding rate remains high and is extended for the next period, then such a bundle can be kept open and funding can be earned until the rate decreases to the minimum values and the bundle is exhausted.

Interexchange Arbitrage Funding Strategy

Core: Funding earnings using multidirectional futures positions on different exchanges.

Execution:

- Two multidirectional trades are opened for the same volume: long on one exchange and short on the other.

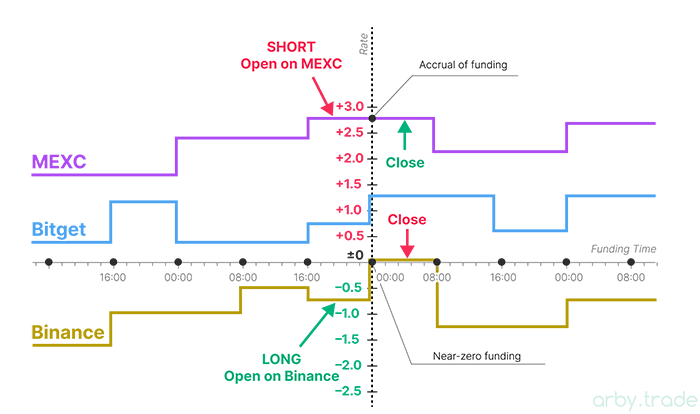

- The sign of the rate does not matter, it is important that the rates vary greatly for the same coin on different exchanges. For example, on the MEXC exchange, the rate is +2.75% (payment to traders with shorts), and on the Binance exchange +0.01%. Then we open a short on MEXC, and open long on Binance for the same amount.

- Both positions hedge each other, earning on the payment of the funding itself for the position that was opened on the exchange with the highest rate, that is, in the example given on MEXC.

- If the rate on one exchange is -2% (here we open a long), and the other is +0.5% (here we open a short), the funding earnings will be on both positions, the total will be earned from fundings 2.5%.

- If the funding rate remains high and is extended for the next period, then such a bundle can also be kept open as long as the rate remains.

- It is important to take into account the fees when opening two deals. The spread between funding rates on different exchanges should be enough to offset fees.

You can practice one of the strategies, or you can combine several. Based on the examples considered, when using a deposit of $1000 and applying 10 leverage, in a few seconds before and after the funding, you can potentially earn about $100 using one of the strategies, one coin, one funding!

A TOOL FOR FINDING TRADING SITUATIONS FOR MAKING MONEY ON FUNDINGS

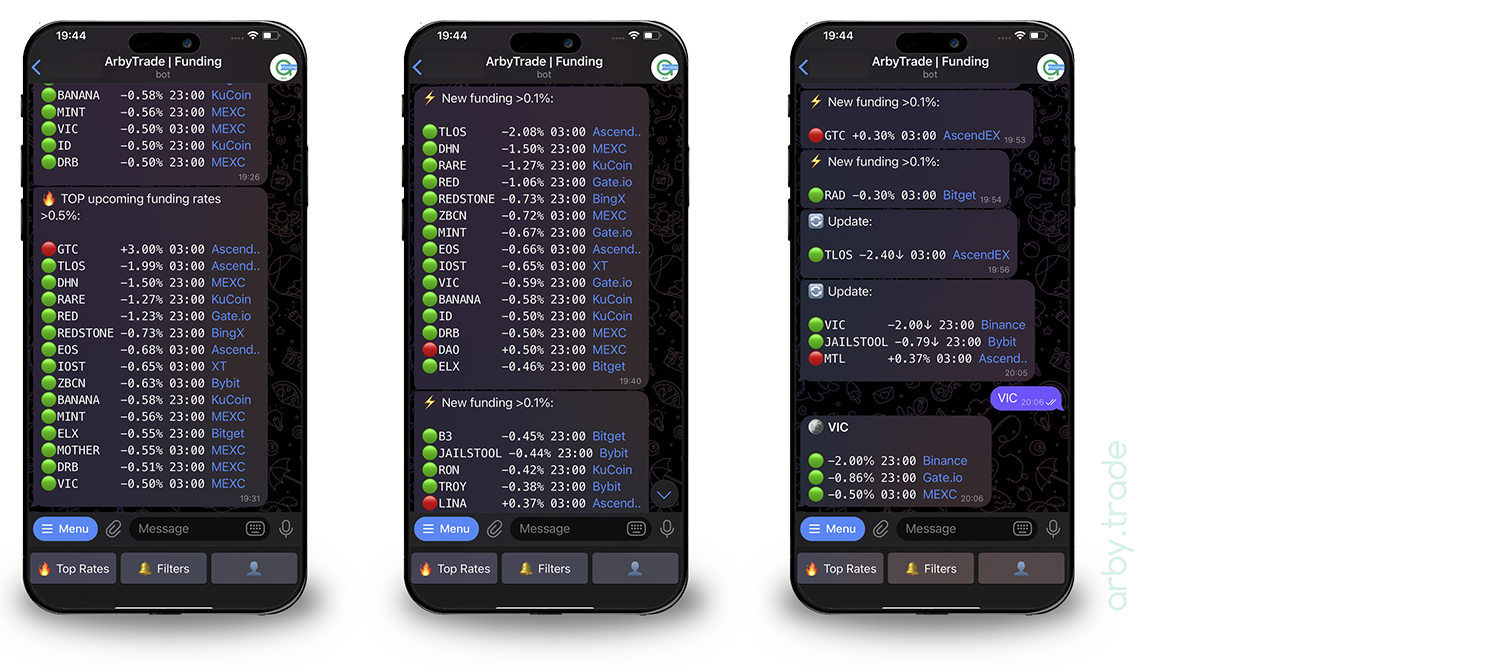

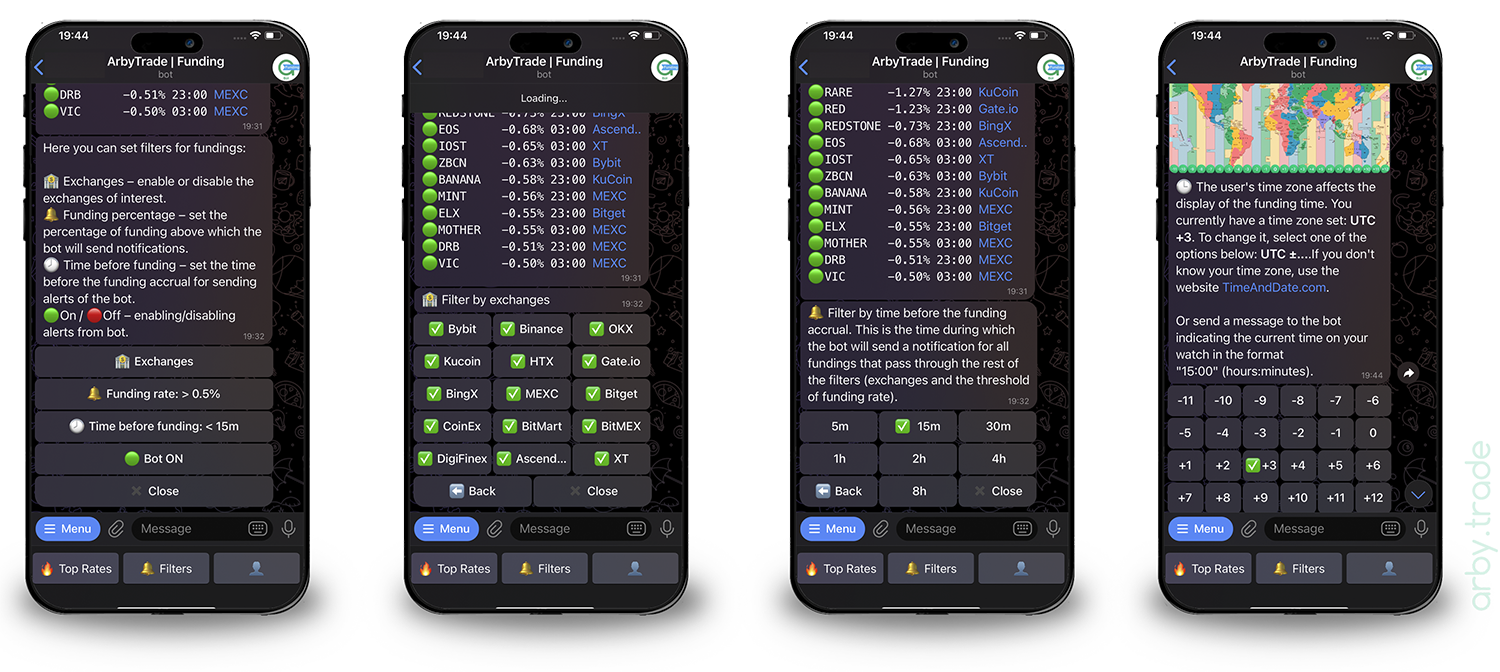

Telegram bot - @arby_funding_bot - real-time bot monitoring 5000+ features on 15 the most popular and liquid exchanges and sends notifications about the highest funding rates on the market.

This is an indispensable tool for trading the strategies described above, as it not only shows the maximum funding rates at the moment of the request, but also notifies about the maximum rates for the time set by the user before the funding time.

The bot also shows which exchanges, when, and what funding for a single coin — this feature allows you to find situations for arbitrage strategies. For example, a bot can be configured so that it sends a notification 15 minutes before the next funding time with a list of all futures on the market with the largest funding rates. After seeing the coins with the rate value -3%, -2.5%, -1.5% and so on, you can immediately send the bot the name of any of the coins and find out on which exchanges the rates for this futures are, where they are high, and where they are near zero, or even with a different sign. (difference in funding rates = profit). Then it’s up to the trader to go to the exchanges, open trades, receive a payout, close trades, and rest until the next funding time.

For more information about the bot’s functions, see the “Guide” section inside the bot itself.

Conclusion

Funding is not just a technical detail hidden somewhere in the corner of a trading terminal, but the heart of perpetual futures on the cryptocurrency market. It keeps futures prices under control, preventing the chaos that could occur without reference to the spot market. This is not only an exchange regulatory tool, but also another source of income. Use it wisely, from arbitrage to catching extremes and impulses.