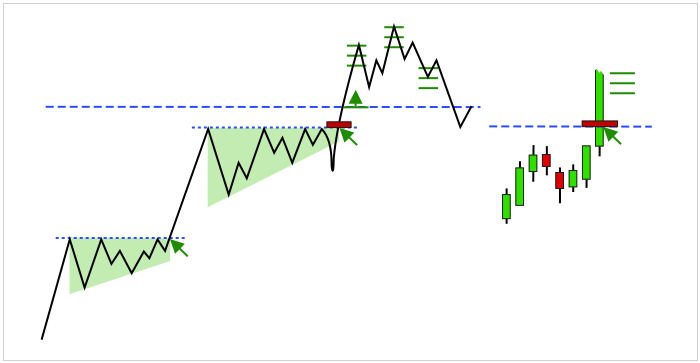

Breakout strategies are among the most profitable and often practiced by traders. The increased potential of breakout strategies is also associated with increased risks, since a large number of manipulations occur during their execution and it is especially important to comply with risk management requirements.

In the section we analyze all the factors contributing to the formation of a true breakout, the nature of the formation of such a price movement.

Inside, 8 options for testing strategies for a breakout are shown:

- ENTERING the POSITION IN ADVANCE before the upcoming breakdown in 5 execution options

- ENTRY AT THE PRICE OF THE LEVEL OF BREAKOUT

- ENTERING A POSITION AFTER THE BREAKDOWN OF THE LEVEL with a pending order

- COMBINED STRATEGY

- BREAKOUT OF THE TREND LINE with moderate movement

- BREAKOUT OF THE TREND LINE with strong movement in 5 versions

- RETEST OF THE LEVEL AFTER THE BREAKOUT

- CANDLE PATTERN TO CONTINUE THE MOVEMENT AFTER THE BREAKOUT

For each variant of the strategy execution, the factors determining a particular situation, methods and entry points into a position, bases and exit points from a stop-loss position, methods and points for determining exit levels from a take-profit position are given.

And also:

– determination of the breakout potential

– additional features of various breakout options