– exiting the incubator. Either it survives, or it dies.

A listing is not a “single event,” but a chain of steps, each of which affects the price, liquidity, spreads, crowd behavior, and market makers in its own way. To trade listings systematically, you need to understand the stages, who exactly is listing the coin, on which market (spot/derivatives), and what type of listing it is (first major exchange, secondary listing, local exchange with premium, restricted listing, airdrop/launchpad, perpetuals without spot, etc.). In this article, we will cover all the stages of a listing, their impact on price, the exchanges whose listings have the greatest influence, and trading strategies built around listing situations.

WHAT IS A COIN LISTING?

A coin listing is the process of adding a cryptocurrency to an exchange, after which it becomes available for buying, selling, depositing, and withdrawing. A listing is the first key event for any crypto project on the market; this stage increases the coin’s liquidity, attracts new investors, and boosts its market visibility.

Stages of Coin Listing

Before traders can trade a coin on an exchange, it goes through several stages:

- Application Submission and Exchange Review

The project submits a listing application, providing information about the coin, including technical specifications, tokenomics, team details, roadmap, and legal aspects. The exchange conducts due diligence, verifying the project’s credibility, smart contract security, and regulatory compliance. - Technical Integration

After approval, the exchange integrates the coin into its infrastructure: adds wallet support, tests deposits/withdrawals, sets up trading pairs, and ensures compatibility with the trading engine. - Listing Announcement

The exchange officially announces the upcoming addition of the coin. This may include the listing date, trading pairs, and deposit/withdrawal conditions. The announcement is often published on the exchange’s website and social media. - Coin Listing

The coin is officially added to the exchange’s asset list. At this stage, it becomes visible in the interface, but trading may not yet be available. - Trading Start

Trading of the coin begins at the specified time. Traders can execute trades in spot or, if available, margin/futures pairs. - Deposit/Withdrawal Availability

The exchange enables deposits and withdrawals for the coin. Sometimes deposits open before trading starts to allow traders to prepare funds, while withdrawals may be delayed to prevent sharp price movements. - Delisting

For various reasons, one or more exchanges may remove the coin — delist it.

IMPACT ON PRICE AT DIFFERENT LISTING STAGES

News about a listing has a significant impact on a coin’s price, especially if it is already trading on other exchanges. This impact is particularly strong when the coin is traded on low-liquidity exchange(es) and a listing on a highly liquid exchange is announced. Below, we will cover only those stages that actually influence the market:

1. LISTING ANNOUNCEMENT

Essence: The exchange publishes the news: “We are listing TOKEN, trading starts on such-and-such date/time”.

What happens:

• Sharp upward impulse on exchanges where the coin is already traded,

• Spreads widen, volatility spikes,

• Followed by a pullback/consolidation (because early buyers take profits).

Important:

• The strength of the reaction depends on the exchange’s status (see the next section on the influence of exchanges on the nature of price movement).

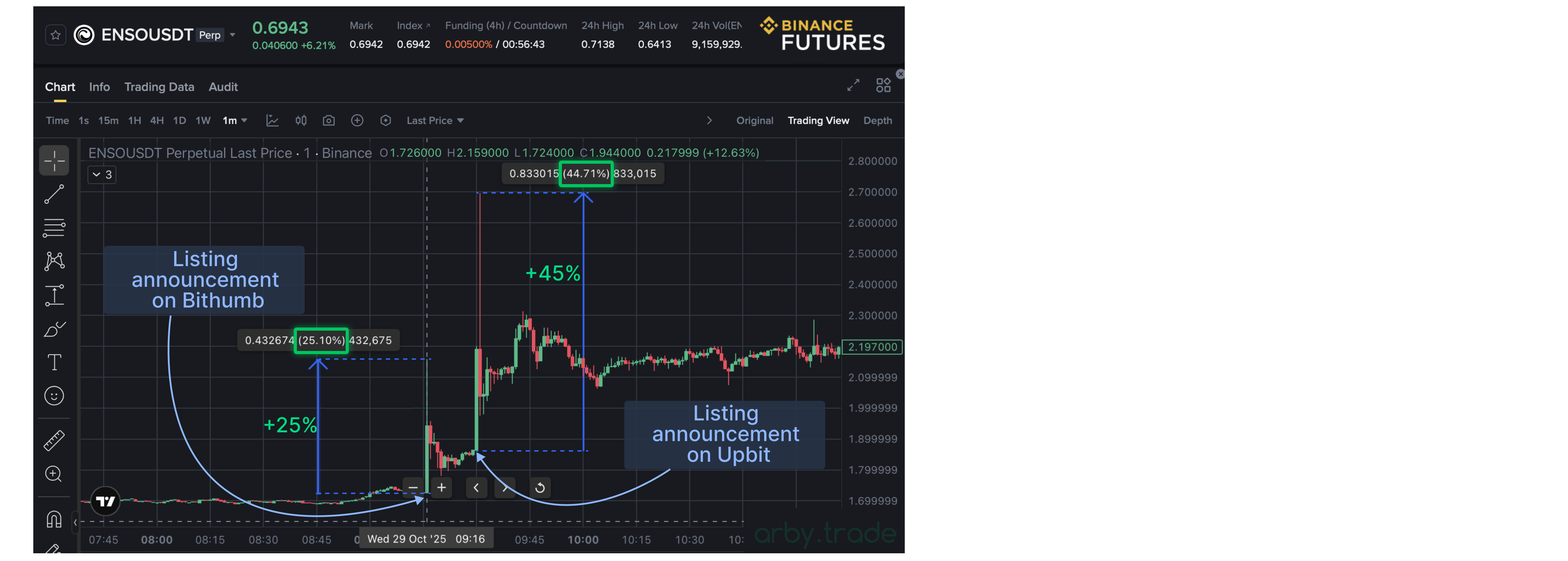

Example: If Binance announces a listing for a coin, the price on other exchanges (e.g., Gate.io, MEXC, Bitget) can rise by 10–50% within a few hours due to speculative hype. Or the coin is trading on Binance, and an announcement comes about a listing on Upbit (the largest Korean exchange) — a pump on Binance is almost guaranteed.

Reason: Traders and investors expect that a listing on a major exchange will attract more attention to the coin, increasing demand.

2. PRE-MARKET/AUCTIONS/LAUNCHPAD (if applicable)

Essence: Before regular trading begins, the exchange may launch a pre-market — a format for trading not the coin itself, but obligations to buy/sell it in the future (when regular trading starts).

Variants:

• Pre-market trading (conditional IOUs),

• Opening auction (delayed price discovery),

• Launchpool/launchpad/earn campaign.

Impact on price:

• Sometimes the most powerful stage, as it forms expectations of a “fair price” and triggers FOMO.

3. LISTING

Essence: Actual addition of the new ticker to the exchange.

Impact on price: The fact of the listing itself may not have a strong effect if the announcement has already caused a rise. However, in most cases, the price also reacts with growth due to FOMO (fear of missing out) among traders.

Example: After the announcement, the price may stabilize, but if the exchange is large, speculators continue to fuel interest, and at the moment of listing, there may be a second wave of growth.

4. DEPOSIT OPENING

Essence: The exchange enables deposits of the coin.

What happens:

• At this moment, the token begins to “flow” onto the listing exchange,

• Market makers/whales may bring tokens in preparation for trading start.

Impact on price:

• Often creates downward pressure if participants send tokens to the exchange to sell at launch (preparing for “sell the news”),

• Or, conversely, strengthens the rise if a shortage is expected and people buy more to deposit on the new exchange.

• If trading has already been active for some time (before deposits open), there was likely a significant price spread between this exchange and others. When deposits open, arbitrageurs enter the game and gradually align the price with other exchanges. If the price on this exchange was overvalued relative to others — it will decline.

5. TRADING OPENING

Essence: The exchange enables free trading of the coin.

Impact on price:

- This is the climax: Impulsive candles, sharp spikes, extreme spreads, and slippage at the start.

- Typical scenario: Pump → dump (most common): upward candle, then profit-taking, then stabilization, followed by a possible pullback.

- Dump → V-reversal: If a lot of tokens were brought to the exchange for sale and “dumped”, but demand turns out to be strong, the price may gradually rise after the dump and possibly update highs at the start.

Example: A coin can rise 20–100% at the moment trading opens, but then fall 30–50% due to “sell-off” (mass selling), token unlocks, or an influx of shorts (if the asset is available for futures trading).

Reason: Traders who bought the coin before the announcement often sell at the peak, leading to a correction.

6. WITHDRAWAL OPENING

Essence: The exchange enables withdrawals of the coin.

Impact on price:

• Direct arbitrage between exchanges begins — the price aligns. If the price was overvalued relative to the average — it will decline; if undervalued — it will rise.

• Liquidity usually becomes “more normal”, volatility decreases.

7. FUTURES LISTING

Essence: The exchange launches futures trading. Sometimes futures launch before spot or instead of spot.

Impact on price:

• Volatility rises sharply, liquidations and “wipes” appear,

• The price starts reacting more strongly to OI (open interest), funding rates, and order book liquidity.

8. DELISTING

Essence: The exchange removes the coin from trading and the platform.

Impact on price:

• First, the exchange announces the delisting date: this news causes an immediate reaction across all markets — the price drops (traders get rid of an asset “something’s wrong with”). If futures are also available, short sellers contribute to the downward move as scalpers open shorts on the news.

• Then comes the actual delisting with the coin’s removal from the exchange: as a rule, this no longer has a significant impact on price, as the delisting news has already been fully priced in by that point.

Important addition to everything above: The larger the exchange on which the event occurs (announcement, listing, trading start, etc.), the greater the described impact on the price will be.

IMPACT ON PRICE DEPENDING ON THE LISTING EXCHANGE

A listing on one exchange has a direct impact on the coin’s price on other platforms where it is already traded. This is due to several factors:

• Increased liquidity: A listing on a major exchange boosts the coin’s overall liquidity, making it more attractive to traders.

• Psychological effect: A listing announcement is perceived as a sign of the project’s quality, increasing demand across all exchanges.

• Arbitrage opportunities: Price differences between exchanges stimulate arbitrage, which can lead to an influx of liquidity from arbitrageurs and price alignment.

• Expectation of a pump at launch

Example: If a coin is trading on Gate at $1, and Binance announces a listing, the price on Gate can rise to $1.2–$1.5 in anticipation of new traders flowing in on Binance. In other words, the coin hasn’t even started trading on Binance yet, but the mere fact that it will soon be available there is enough for traders to drive the price up on these expectations.

In essence, it’s not the listing itself that matters as much as the expected inflow of liquidity — and the larger the exchange, the greater the expected liquidity inflow, and thus the stronger the impact.

IMPACT FROM SPECIFIC EXCHANGES

Below is not a “ranking by prestige,” but pure logic based on audience size, reputation, geography, and typical capital flows.

Binance

• Often delivers the maximum reaction to the announcement and trading start;

• Binance = massive audience, lots of spot, lots of futures, lots of arbitrageurs;

• Frequently features a “first-hour effect”: high volume, extreme candles, followed by stabilization.

Peculiarity: Binance sometimes launches futures/margin first, which dramatically changes the price dynamics (see the spot vs. futures section).

Coinbase

• A listing on Coinbase sends a strong signal of the coin’s “legitimacy” (regulatory perception + wide US retail), which boosts trust in the project and the coin, leading to hype.

Upbit

• Largest South Korean exchange;

• Often triggers a Korean premium: the token can trade noticeably higher on Korean exchanges;

• An Upbit listing can produce extremely powerful impulses, especially if a KRW (South Korean won) trading pair is announced.

Bithumb

• Also targets Korean audience, but the effect may differ in terms of liquidity/pairs/rules;

• Overall reaction is similar to an Upbit listing.

Bybit

• Strong derivatives audience, fast movements, aggressive “wipes”;

• If the listing is specifically for futures — often more volatility than “healthy” growth;

• Price impact is generally moderate.

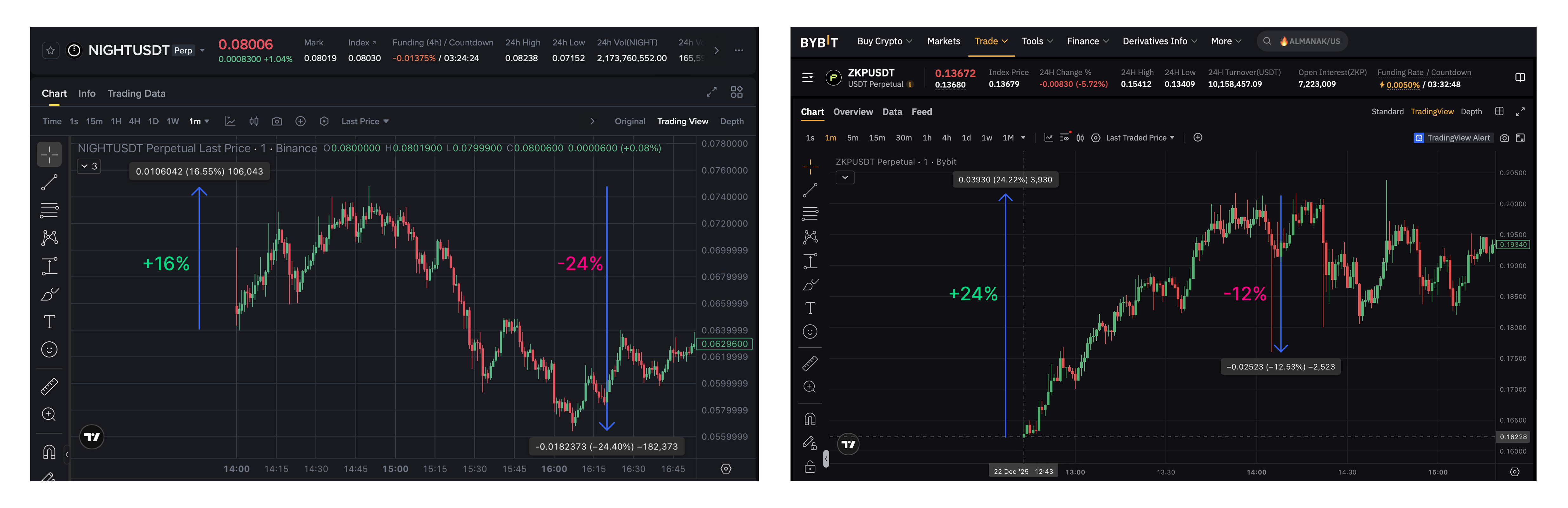

One common pattern stands out — at the moment of announcement, the price shows a rapid rise, after which a correction often follows as traders take profits.

At the moment trading starts — there is often an upward impulse, followed by a correction. At the start of trading on Binance, it is common to see short-selling pressure right after launch.

SPOT VS. FUTURES LISTING

Spot listings more often provide a “structural” effect

• Real demand for owning the asset (not just a bet on price movement as with futures),

• Inflow of retail,

• Possible inclusion in portfolios/watchlists.

Futures listings more often provide a volatile effect

• Leverage = movement accelerator,

• Liquidations = cascades,

• Funding and OI create additional drivers,

• Often easier to manipulate short-term (thin order book + leverage).

In practice:

• If futures launch before spot: the price can be “accelerated” by futures, but without spot demand, it often results in “pump-dump-saw”.

• If spot + futures launch together: impulses are strong, but price stabilizes faster.

HOW TO TRADE LISTINGS. THE BASICS

Based on everything above, we can highlight the following key points that form the foundation of trading strategies built around listings:

- Initial official announcement — delivers the fastest price acceleration and trading potential. Provides a long setup, and after some time — a short setup.

- Trading start — delivers the highest volatility and volume, but not always the best risk/reward; suits volatility-harvesting strategies. After some time, it provides a short entry point.

- Deposit/withdrawal opening — creates arbitrage opportunities, not only futures but also cross-exchange spot arbitrage.

- Futures/margin launch (if not previously available) — can be a “second engine”, sometimes stronger than the spot start.

- Delisting — ideal news for shorting if futures are available for trading.

TRADING STRATEGIES FOR LISTINGS

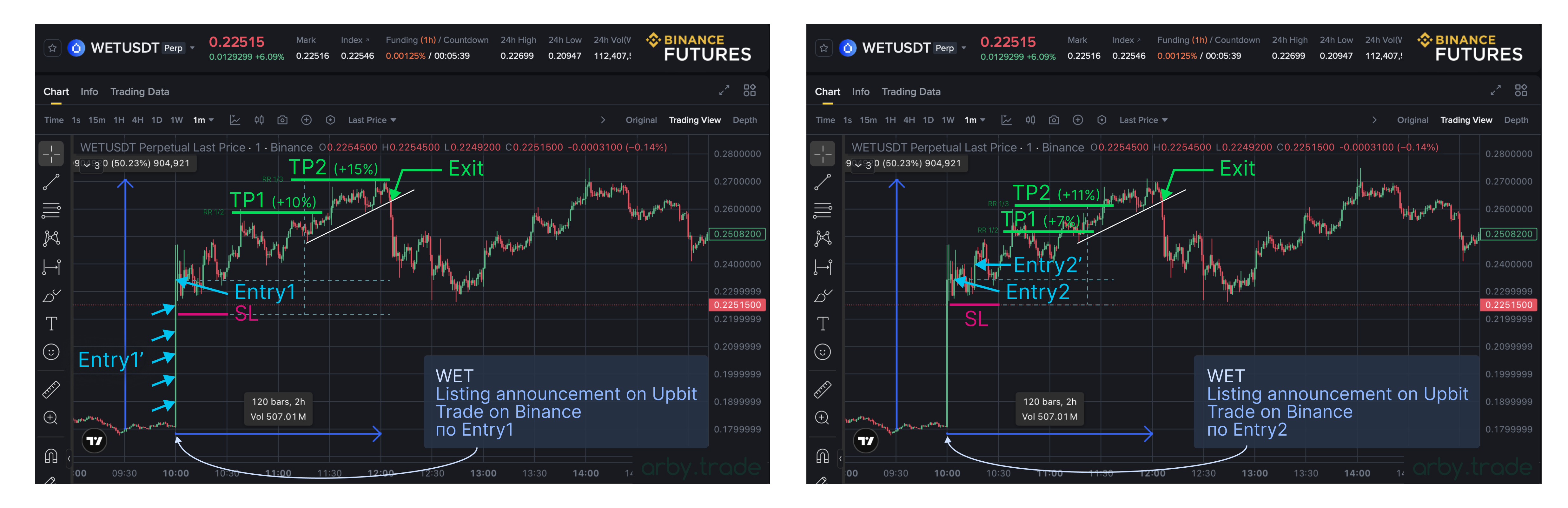

1. STRATEGY: LONG ON LISTING ANNOUNCEMENT

IDEA:

Capture the initial long movement on the announcement of a listing on a major exchange (Upbit, Bithumb, Binance).

ENTRY:

• ENTRY 1: Enter immediately after the announcement in the first minute. In the example, ENTRY1’ points mark the section of the first minute where entry could have potentially occurred. Alternatively, enter at ENTRY1 on the close of the first minute candle after the announcement.

• ENTRY 2: If ENTRY1 was missed, enter on the 2nd–5th minute after the announcement following a price pullback.

SL:

• For ENTRY1: 3–5% from the entry point

• For ENTRY2: Behind the entry candle + a small buffer. Once RR 1/1 is reached or the first take-profit is hit — move SL to breakeven.

TP:

• TP1: at RR ½-1/3

• TP2: When price slows: price stalls for several minutes; or reversal candle formations appear; or large densities appear at resistance; or large market sells occur.

• Full exit: If partial profit-taking was used along the way, close the remaining position fully at strong resistance and/or breakout of any local structure (horizontal level or trend line, as shown in the example).

TRADE DURATION:

The first take-profit is usually hit within the first 30 minutes; subsequent ones may take an hour or two.

2. STRATEGY: SHORT AFTER LISTING ANNOUNCEMENT

IDEA:

Enter short after the listing news has played out and the coin’s pump has exhausted itself. The short entry point after a listing announcement or actual listing typically forms 1–1.5 hours later. Unlike the previous strategy, here there is time for analysis and calmly waiting for the entry point.

OPTION 1:

ENTRY:

Enter on the breakdown of any local structure downward (horizontal level or trend line, as in the example). Aggressive entry — at the moment of breakout; more conservative — on pullback or retest of the broken level or trend (though such a point may not be given). In the example, the price broke a super-local trend line on the 1m TF, then broke the next trend line on the 5m TF. Entry could have been taken at any of these points.

SL:

Behind the local high of the broken structure or candle, or a logical stop if price returns above the broken level and consolidates.

OPTION 2:

ENTRY:

If Variant 1 entry was missed, enter on the retest of the broken structure: price broke the level (or trend line), then returned to it again but failed to consolidate and bounced off it as resistance — enter here. In the example, a more complex execution is shown: price retests (closes) the middle of an unfilled gap (highlighted in yellow), from which it bounces as from resistance. After breaking the local trend line, a long red candle formed. Often price quickly returns to “close” this gap and continues moving. Depending on the strength of pressure, it may fully or partially cover such gaps. After the zone was tested — enter on the confirmation candle (the first red candle after retest).

SL:

• Behind the upper boundary of the unfilled gap.

• Behind the local high

• Depending on the ENTRY point.

TP FOR BOTH VARIANTS:

• At RR 1/2—1/3

• Full exit on appearance of reversal formations with vertical volume spike or clear slowing.

TRADE DURATION:

First take-profits may be hit in 30 minutes to an hour. Subsequent ones may take hours or even a day.

3. STRATEGY: SHORT ON DELISTING ANNOUNCEMENT

IDEA:

Capture the short movement after the announcement of a coin delisting from a major exchange.

OPTION 1:

ENTRY:

Enter short immediately after the delisting announcement in the first few minutes. Entry within the first 3 minutes is acceptable. If entry is not possible in that time, either skip the situation or see Variant 2.

SL:

Behind the high of the candle before the delisting announcement (if entry is close to the announcement), or at 3% if entry was later than the first minute.

OPTION 2:

ENTRY:

If Variant 1 entry was missed, enter on the retest of the broken structure: price broke the level (or trend line), then returned to it again but failed to consolidate and bounced off it as resistance — enter here. In the example, a situation similar to Variant 2 of the previous strategy is shown — entry after covering 50% of the unfilled gap + confirmation candle. Entry is taken on the close of the first confirmation candle (red, in the direction of the trade).

ENTRY 1: More aggressive entry point, as the confirmation candle is small. In this case, it makes sense to place SL behind the upper boundary of the unfilled gap — SL2.

ENTRY2: More confident confirmation candle — SL can be placed behind the recently formed local high — at SL2 level.

SL:

• SL1: Behind the upper boundary of the unfilled gap

• SL2: Behind the local high

• Depending on the ENTRY point.

TP FOR BOTH VARIANTS:

• At RR 1/2-1/3

• Full exit on appearance of reversal formations with vertical volume spike or clear slowing.

TRADE DURATION:

Several hours to a day.

GENERAL NUANCES WHEN TRADING THESE STRATEGIES

• The larger the exchange from which the news about listing/delist came — the greater the trade potential.

• Regardless of which exchange the news came from, any of these strategies for a coin can be traded on any convenient exchange where the coin is available and you have an account. If you have a choice of exchanges for trading a particular situation, prefer the one with the highest liquidity, futures trading availability, and no strict position size restrictions. In general, Binance, Bybit, and Gate are suitable for the vast majority of situations.

• The best option for trading listings is to trade on Binance using a desktop trading terminal for professional traders. Due to higher liquidity on Binance, there are fewer silly squeezes up/down that might hit your stop prematurely, larger positions are easier to open and close without significant slippage. A trading terminal allows you to open/close trades in under a second without manually entering amounts, prices, order types, etc. For more details on using this software, see the section Trader’s Hardware and Software | Software.

• If for some reason you cannot create an account and trade on Binance or Bybit, you can use our referral link to register with a crypto broker, create an account on any of these exchanges through the broker, and trade using a trading terminal.

Here are two reliable and time-tested crypto brokers we have been working with for several years and trade ourselves using sub-accounts and their terminals: Tiger.Trade, Vataga.

TOOL FOR RECEIVING AND FILTERING LISTING SIGNALS

Listing trading bot — @arby_listing_bot

The bot in Telegram sends notifications about every step of a coin’s journey from listing announcement to delisting and removal from exchanges.

BOT FEATURES:

✅ Announcements from over 40 exchanges.

✅ Notifications about listings, trading starts, and delistings from 15 major exchanges: Bybit, Binance, OKX, MEXC, Gate, KuCoin, Ourbit, HTX, Bitget, BingX, CoinEx, LBank, XT, Hyperliquid, BloFin

✅ Notifications about changes in deposit/withdrawal status for any specified coin.

✅ Custom personal reminders for any scheduled market events so nothing is missed.

✅ In the signal message for a coin, detailed information is immediately available about all markets where the coin is traded, deposit/withdrawal availability, with all prices and position size limits.

✅ For any coin in the signal, detailed project information is available — project description, market cap, links, and social networks.

✅ Allows filtering signals:

• by event type

• by exchanges for each event type

• by markets (spot/futures)

• by maximum position size allowed by a particular exchange. If an exchange has a position size limit lower than the one set in the filter, the bot will mark that exchange and indicate the limit set by the exchange.

BOT FILTERS

- Announcement Filter: Filters signals related to listing announcements. You can enable/disable this signal type, choose which exchanges to receive these signals from, and which markets (spot/futures). This filter also includes delisting announcements.

- Listing Filter: Filters signals about actual listings — moments when the coin is officially added to an exchange. You can enable/disable this signal type, choose which exchanges and markets to receive these signals from.

- Trading Start Filter: Filters signals about trading start — the moment when the coin becomes tradable. Filter settings are similar to the previous ones.

- Deposit/Withdrawal Filter: Allows tracking changes in deposit/withdrawal status on exchanges — whenever the status changes on any exchange connected in the listing filter (point 2), the bot will send a notification.

- Maximum Position Size Filter: Allows setting a threshold position size. If an exchange has a restriction on maximum position size lower than the threshold set in the bot, the bot will indicate this in signals and specify the limit set by the exchange.

- Personal Custom Reminders Tab: Allows setting your own reminders for any date/time in free form. At the time specified by the user, the bot will send a reminder. Reminders can be added from the tab or via a button in the signal to ensure nothing is missed.

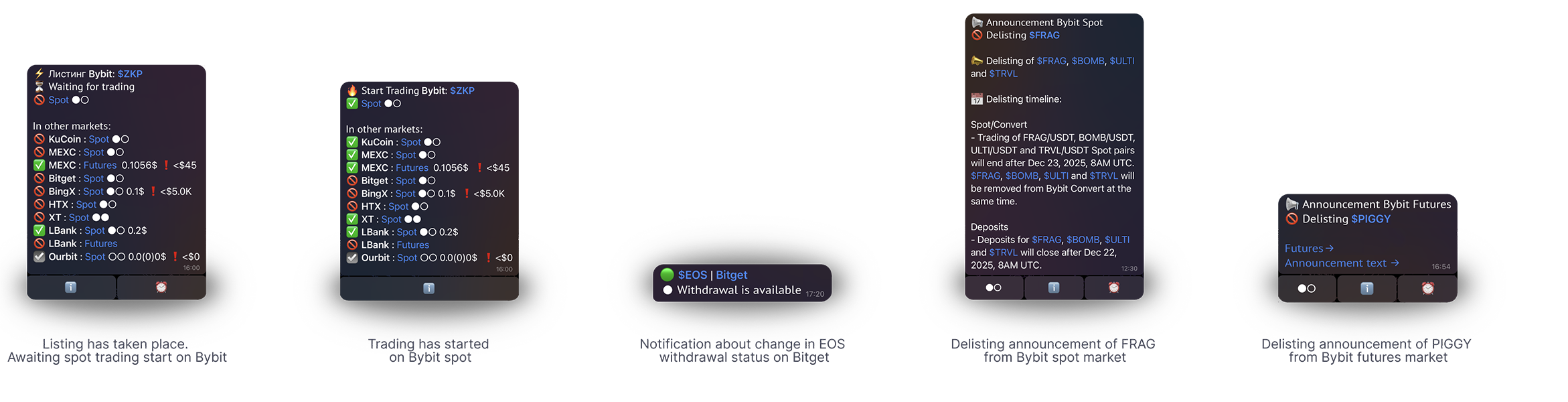

BOT SIGNAL MESSAGES

- Notification about the listing announcement of ZKP coin on Bybit spot. Buttons in the message allow you to immediately check where the coin is traded, view project information, and set a reminder.

- List of exchanges and markets where the coin from the announcement is already traded.

- Trading status

- Deposit/withdrawal status for the coin on the exchange

- Exchange position size restriction. Example: on MEXC futures, the maximum position size is limited to 7,000$.

- Project information: project description, investor list, social networks, tokenomics, contract addresses.

- Setting a personal reminder for the event at the desired time.