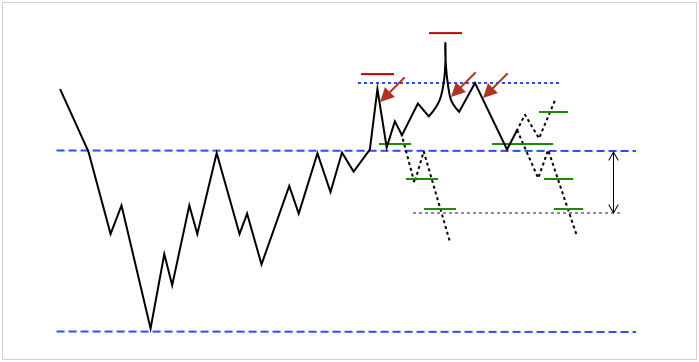

Since there is a fairly large number of manipulations and false price movements on the market and it occurs quite often, the skill of determining the truth or falsity of a particular movement allows not only to improve the quality of working out true breakouts, but also opens the door to a whole layer of strategies focused specifically on false movements – stabs and false breakouts.

It is highly desirable, before starting to study strategies for working out false breakouts and stabs, to study and master the strategies of true breakouts and bounces. So the understanding of market movements will be formed in the correct sequence, which will increase the trading efficiency of each of the strategies.

In the section we have analyzed the mechanics of market behavior, the reasons leading to the formation of false movements and factors that allow us to assume with high probability the upcoming false movement.

Inside the section there are 7 strategies for working out stabs and false breakouts:

- FALSE BREAKOUT. THE ENTRY POINT AT THE BREAKOUT OF THE LOCAL LOW. ENTRY POINT BEFORE THE LEVEL

- FALSE BREAKOUT. THE “DOUBLE BOTTOM” FORMATION. ENTRY POINT IN FRONT OF THE LEVEL.

- FALSE BREAKOUT/STAB. ENTRY POINT FROM RETEST

- FALSE BREAKOUT. ENTRY POINT BEHIND THE LEVEL, BY CANDLE PATTERN

- STAB. ENTRY POINT BEHIND THE LEVEL, BY CLUSTER ANALYSIS

- STAB. A SHARP IMPULSE. FUTURES AND SPOT UNCORRELATION

- COMBINED STRATEGY. 3 ENTRY POINTS BEHIND THE LEVEL

For each strategy, the factors and grounds for making a decision to open a deal, methods and entry points into a position, bases and exit points from a stop loss-position, methods and points for determining exit levels from a take-profit position are given.