- SIGN UP FOR A LESSON

READY-MADE STRATEGIES

This section contains all the actual scalping strategies for trading in futures markets. Each of them has been repeatedly worked out by our team and thousands of scalper traders around the world. We have collected all the experience we have and packed it into an accessible structured format, supported by a detailed description, examples and specific tricks adapted to the crypto market.

For each strategy, ready–made variants of working out are given, prerequisites for the occurrence of an appropriate situation on the asset for further working out, the correct reading of signals in a given situation coming from the trader’s main tools - charts, the behavior of the print feed, the analysis of the order book, the analysis of volumes and clusters.

Each strategy contains examples of graphical and candlestick formations, factors determining a particular market situation, options and points of entry into a trade and exit by takeprofit (TP) or stop-loss (SL).

We have specially divided all trading strategies into separate modules with the possibility of acquiring access to them separately, choosing only those that are of the greatest interest to you at the moment. This way you will be able to advance in the study of the trading craft at the speed that is comfortable for you.

But you can purchase access to all modules at once by choosing the “PRO” package, getting lifetime access to all the presented strategies and their updates, while saving 20%.

Attention! Access to the purchased materials is provided only from the IP address from which the purchase was made. If your IP address has changed, you can change it yourself in your personal account in the Settings section.

Pro Package

Access to all paid Encyclopedia content

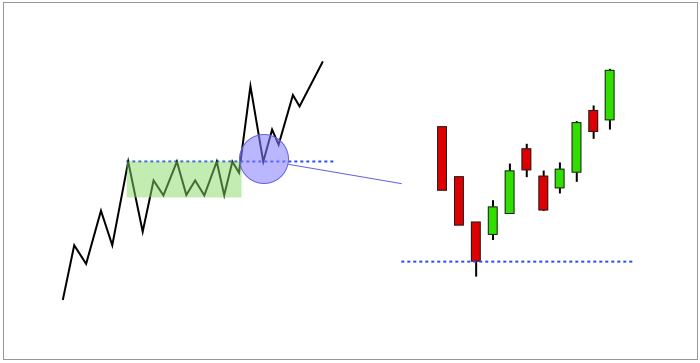

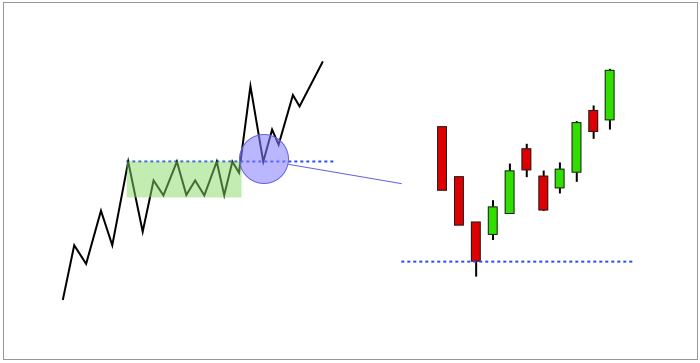

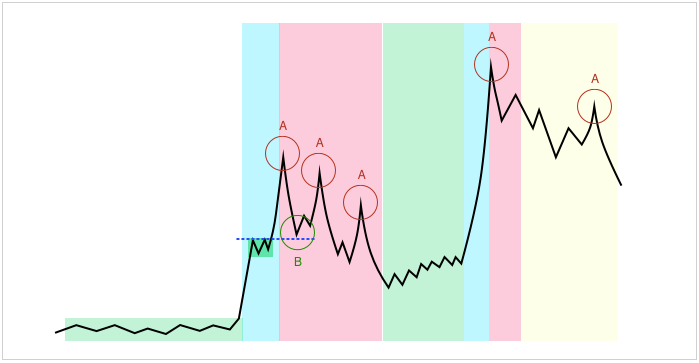

Bounces strategies are among the best for beginners to work out, as they involve well-controlled risks, short stop-losses and a high probability of working out.

The section contains 4 main factors that lead to price rebound and 6 STRATEGIES for working out strategies for rebound.

For each variant of the strategy execution, the factors determining a particular situation, methods and entry points into a position, bases and exit points from a stop-loss position, methods and points for determining exit levels from a take-profit position are given.

More details >

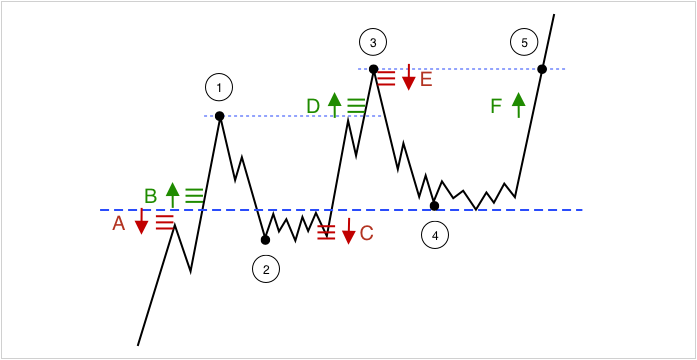

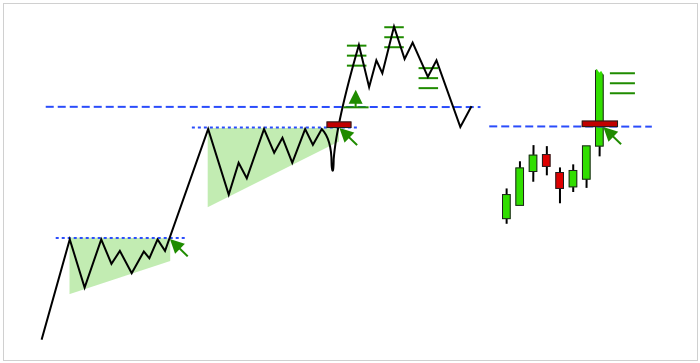

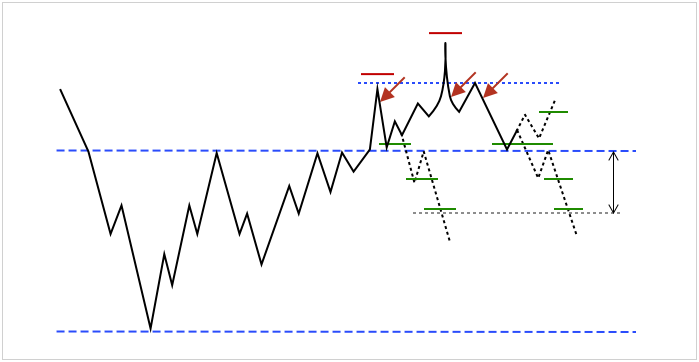

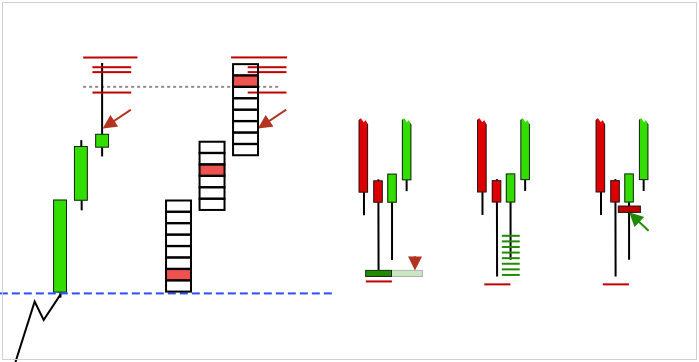

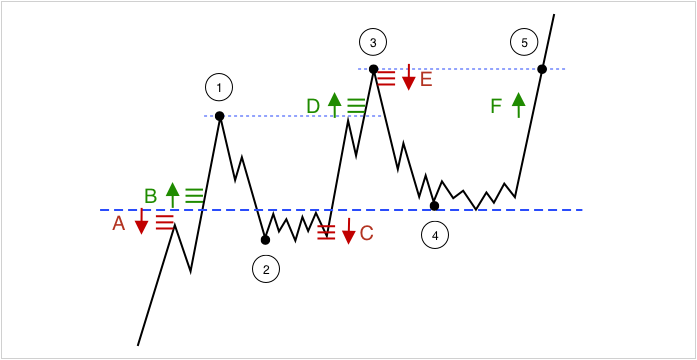

Breakout strategies are among the most profitable and often practiced by traders. The increased potential of breakout strategies is also associated with increased risks, since a large number of manipulations occur during their execution and it is especially important to comply with risk management requirements.

In the section we analyze all the factors contributing to the formation of a true breakout, the nature of the formation of such a price movement.

The section shows 8 STRATEGIES for working out the breakouts.

For each variant of the strategy execution, the factors determining a particular situation, methods and entry points into a position, bases and exit points from a stop-loss position, methods and points for determining exit levels from a take-profit position are given. And also determination of the breakout potential and additional features of various breakout options.

More details >

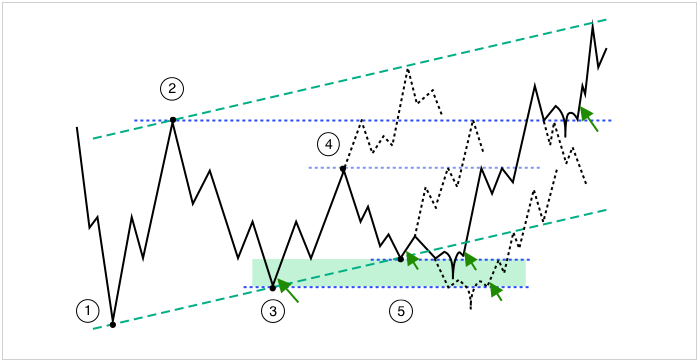

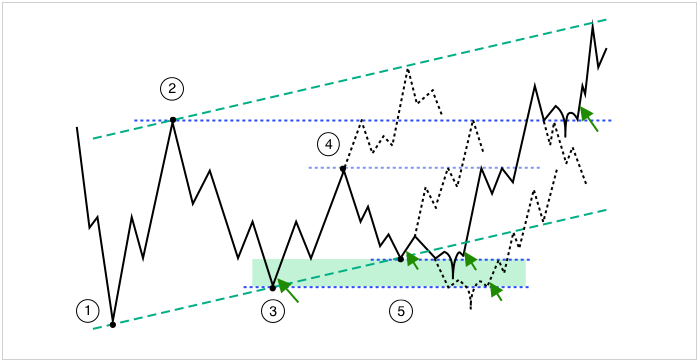

Trend trading is one of the safest trading strategies. Since trades made in the direction of an already formed trend are statistically more likely to have a positive outcome than, for example, countertrend trades.

In the section we analyze the mechanics of market behavior in the formation of trend movements, the formation of inclined and trend channels.

As well as a detailed analysis of 6 STRATEGIES for trend trading.

For each variant of the strategy execution, the factors determining a particular situation, methods and entry points into a position, bases and exit points from a stop-loss position, methods and points for determining exit levels from a take-profit position are given. And also, the basic rules for determining the levels of correction.

More details >

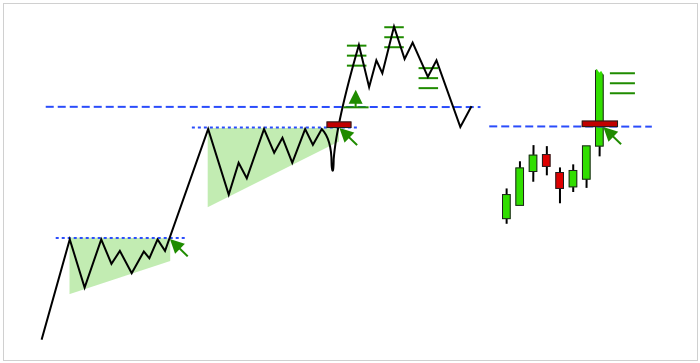

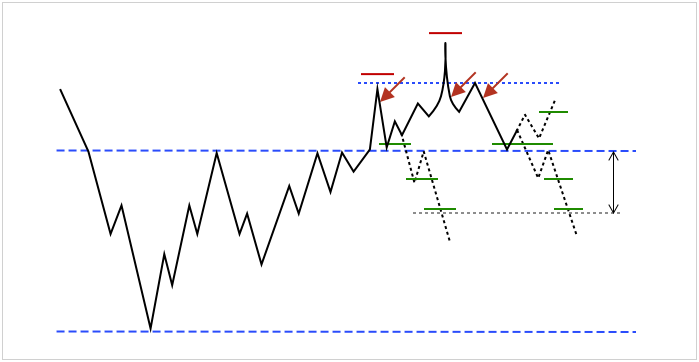

Since there is a fairly large number of manipulations and false price movements on the market and it occurs quite often, the skill of determining the truth or falsity of a particular movement allows not only to improve the quality of working out true breakouts, but also opens the door to a whole layer of strategies focused specifically on false movements – stabs and false breakouts.

In the section we have analyzed the mechanics of market behavior, the reasons leading to the formation of false movements and factors that allow us to assume with high probability the upcoming false movement.

Inside the section there are 7 STRATEGIES for working out stabs and false breakouts.

For each strategy, the factors and grounds for making a decision to open a deal, methods and entry points into a position, bases and exit points from a stop loss-position, methods and points for determining exit levels from a take-profit position are given.

More details >

The strategy of catching a knife is one of the most risky, but also profitable strategies. Risks are associated not only with particularly high volatility, but also with technical risks. And what makes this strategy especially profitable is that when it is worked out, it turns out to catch a market reversal, getting increased profits by applying a scalping approach to entering a position and a positional approach to holding a position.

The article examines the mechanics of market behavior leading to large impulse movements, as well as gives TWO STRATEGIES for catching a knife when moving long and strategies when moving short.

For each strategy, the factors and grounds for making a decision to open a deal, methods and entry points into a position, bases and exit points from a stop loss position, methods and points for determining exit levels from a take profit position are given.

More details >

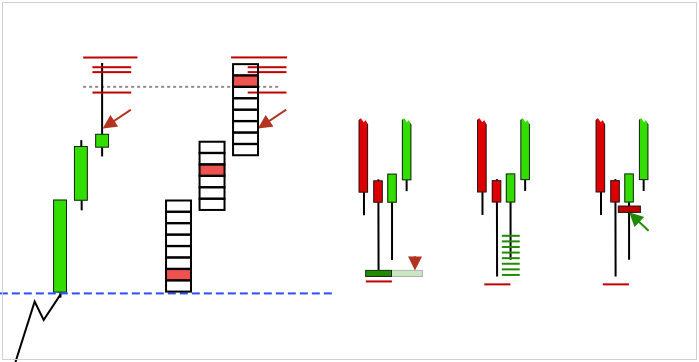

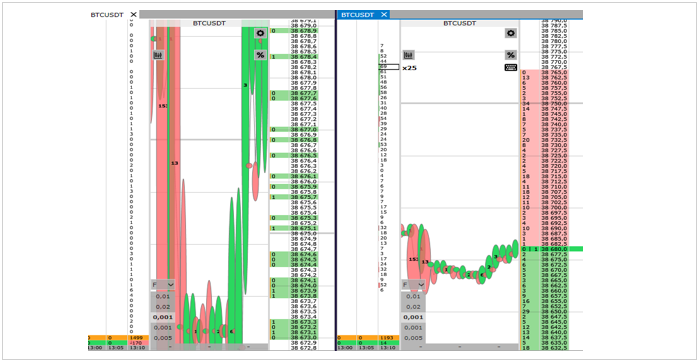

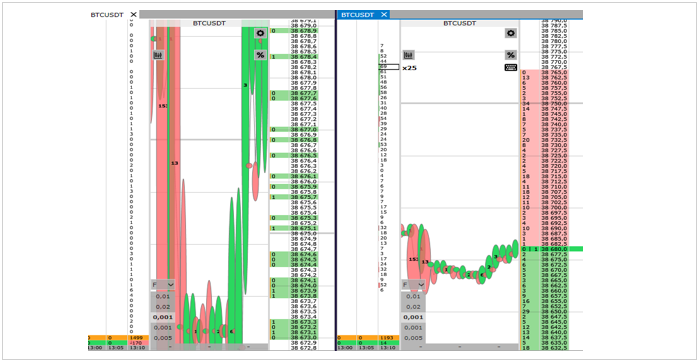

Volatility trading is a trading strategy focused exclusively on super local scalping situations with profit taking in a short price range. This also includes the strategy for earning on the spread.

The peculiarity of these strategies is not an attempt to pick up one price movement and hold a position, but to make a whole series of transactions within the framework of working out the same trading situation.

Working out these strategies is a classic scalping approach to making money in the market.

The article analyzes the STRATEGY FOR EARNING ON THE SPREAD, as well as two options for working out a STRATEGY FOR EARNING ON VOLATILITY.

For each of the strategies, the reasons leading to spikes in volatility, the reasons for making a decision to open a deal, methods and entry points into a position, bases and exit points from a stop loss position, methods and points for determining exit points from a take profit position are analyzed.

More details >

Trading in the range is a rather risky activity, as it is accompanied by significant uncertainty in the market, a decrease in activity and manipulations, as a result of which it has increased risks. Nevertheless, this is one of two possible market conditions and it is important to be able to make money on the market in the range phase, since such phases happen often and are long.

The section contains various options for ranges, features of their formation and trading in ranges, and 4 STRATEGIES for working out this phase of the market with additional execution options.

For each of the strategies, the reasons for making a decision to open a trade, the factors determining the subsequent movement, methods and entry points into a position, bases and exit points from a stop-loss position, methods and points for determining exit points from a take-profit position are given.

More details >

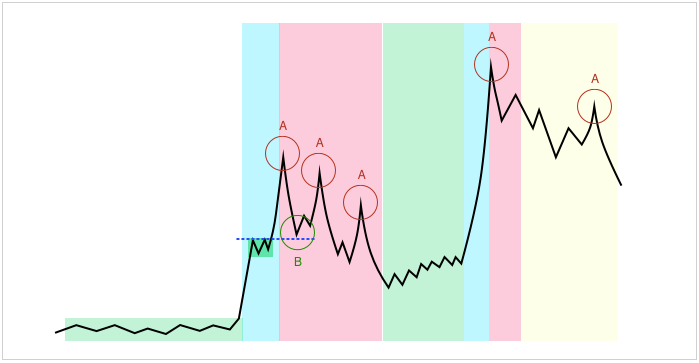

Pumps and dumps are market situations that can give especially increased profits. However, in order to get the most out of such situations in the market, it is necessary to first study the main strategies for bounces, breakouts, false breakouts, catching a knife and volatility trading. Each of these strategies will be needed for high-quality testing of pump situations.

The section presents the global structure of market behavior before, at the time of the pump and after, the causes and factors leading to the formation of such formations, methods for calculating and predicting the development of such formations.

For each execution option, the reasons for making a decision to open a trade, methods and entry points into a position, bases and exit points from a stop-loss position, methods and points for determining exit points from a take-profit position are given.

More details >

It is necessary to separate two fundamentally different concepts that technically look the same: a set of positions in parts in a certain price range and the actual averaging.

In both cases, the trader add volume to the trade when the price goes against him, thereby reducing the average entry price into the trade. The difference is that in the first case, the trader has determined the entry range in advance, divided the working volume into parts, enters the position gradually as his limit orders are executed and understands in advance under what events and at what price he will exit the transaction at a stop-loss. In the second case, the trader thoughtlessly averages the entry price into the position, increasing the trading leverage, increasing the risks in the hope that the price will sooner or later go in his direction, but often this approach only leads to the forced liquidation of the position of the position and the loss of the deposit.

More details >

Here we will analyze the concepts of efficient and inefficient markets. What are their features and the nature of their occurrence. We`ll consider all possible variants of inefficiencies that determine certain movements in the market, create trading situations in which you can make good money.

The section contains detail 7 STRATEGIES and different options for working out.

These strategies are mostly designed for experienced traders who have sufficient experience in the market, who are able to strictly follow the rules of risk management and react with lightning speed to the appearance of one or another inefficiency in the market.

More details >