“Trading is the most difficult path to easy money”

THE RIGHT ATTITUDE TO TRADING AS AN OCCUPATION

Trading is as similar as possible to doing your own business.

In fact, he is, and this is exactly the attitude he demands of himself. The simplicity and ease with which transactions can be opened in the market creates the illusion of a simple business. And coupled with successful deals, there is also the illusion of easy money. But, unfortunately, these are just illusions. In a normal business, you hire staff, purchase something, and then sell the result of the work of this staff or a repackaged/modified product. You have suppliers of goods/services and buyers of these goods/services. And your task as an entrepreneur is to create some added value due to which these goods and services will cost more, due to which your business will generate profit. You should also have an accountant who will calculate taxes, and maybe even a financial director who will inform you in time about the deviation of certain financial indicators and offer options for improving the financial situation in the company.

Almost everything is exactly the same in trading. You buy an asset from someone in order to resell it with your margin after a month, a day or a second. The only difference is that all the processes described above occur as quickly as possible. As a trader, you are both the owner of this business (a trading deposit is your capital, an investment in this business), and a director (you administer all processes), and a buyer, and a seller, and an accountant, and a financial director (collecting and analyzing trade statistics, developing and analyzing your trading strategies, correction and error correction) in one person!

Almost everything is exactly the same in trading. You buy an asset from someone in order to resell it with your margin after a month, a day or a second. The only difference is that all the processes described above occur as quickly as possible. As a trader, you are both the owner of this business (a trading deposit is your capital, an investment in this business), and a director (you administer all processes), and a buyer, and a seller, and an accountant, and a financial director (collecting and analyzing trade statistics, developing and analyzing your trading strategies, correction and error correction) in one person!

A professional trader is like a robot or an operator who strictly follows the rules of his trading system, which he has worked on before, collected statistics on it, honed and modified. It is with this approach that trading becomes a business, a calculated business in which you invest your time and money, and with a pre-calculated mathematical expectation you make a profit. Just like that only!

If you are not ready for the described attitude to this craft and this approach, it is better to avoid this direction immediately, for you it will be a game and regular losses. If you are ready – fine, study all the material gradually, it is more than enough to succeed in the market, start trading, collect statistics, hone your skill and become a professional.

WHY SCALPING, WHY FUTURES, WHY ON THE CRYPTO MARKET?

Why Scalping?

– this is a type of trading in which the trader does not predict the price movement for a period of more than 1-5-10 minutes, which allows you to work in any market (falling, rising or sideways) and any instrument. The scalper works out local trading situations when he sees various inefficiencies of the market. A scalping trades can last literally a few seconds. Nevertheless, trades opened in the scalper style may have chances to move into the category of intraday, swing trades or even medium-term. It is the scalping approach that allows you to find the best entry points into the market, and this is the experience that will allow you to successfully switch to more measured (long-term) trading styles in the future. Scalping exposes the very essence of trading and allows you to make the greatest profit relative to this deposit with the smallest deposit.

Why Futures?

– this is a derivative of the main asset, which allows you to buy for an amount greater than you have in your account, or sell when you do not have it. This means that:

- You can operate on the market with a much larger amount than you actually have (working with leverage; on borrowed funds from the exchange), and

- It is possible to open short trades despite the fact that you have not previously bought the asset that you decided to sell. That is, on futures, at any time, it is possible to open trades both in long (buy) and short (sell).

For ease of perception, you can think of futures as a sports bet: “buy” – I bet that the price will go up; “sell” – I bet that the price will go down. For example, Bitcoin traded to USDT on the spot market (BTC-USDT pair) can only be bought, it can only be sold when it has already been bought from you before. And Bitcoin futures – BTC-USDT-PERPETUAL – can be bought and sold, regardless of whether you have it in your account or not. All this means that two types of trades are always available to a scalper trading futures – long and short – and this is twice as many trading situations on which you can earn, compared to trading on a regular spot market.

Why Crypto?

– this is the most volatile market today, and volatility is good for a scalper trader, since the greater the volatility (the greater the amplitude of price fluctuations per unit of time), the more and faster you can earn. Volatility is inevitably linked to the concept of liquidity – that is, how much money circulates on a particular asset. The more liquid the instrument (for example, the S&P500 index or BTC), the less volatility it has. The less liquid the instrument is (that is, less trade turnover, fewer market participants), the greater the volatility. The instruments of the crypto market have a fairly large spread among themselves according to these indicators – there are coins where $ 10,000 is enough to seriously affect the price (low-liquid), and there are coins where $500,000 will not be noticed by the market (highly liquid). That is why the cryptocurrency market, with the right approach and experience, allows you to choose the most suitable assets for yourself and make good money in the shortest possible time compared to classical markets.

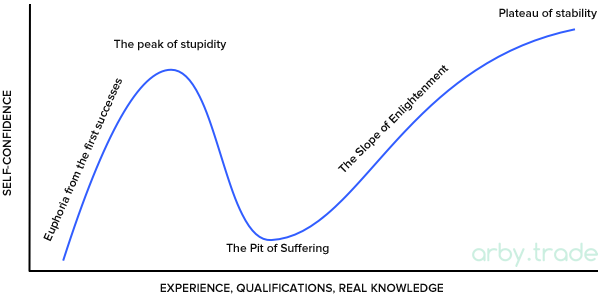

BECOMING A TRADER. THE DUNNING-KRUGER EFFECT

The essence of the effect is that when you are just at the very beginning of the journey, full of great mood, hopes and having seen enough of someone else’s success, when you have no fears yet, and the desire to take risks and earn excessively, you break into the market and start actively trading. And if at this moment you get into a more or less favorable phase of the market, volatile, forgiving of mistakes, you - a beginner – may even be lucky for some time, you make positive trades and earn. This inspires even more, there is a feeling that you have learned the “grail” of the market, that you are a born trader and know how to earn.

At this point, you can even increase your deposit or increase your leverage to earn even more (thereby further increasing your risks). But, since you do not yet have a clear trading system, established rules and self-control, there inevitably comes a time when the market “punishes” you (in fact, the market never punishes anyone, traders punish themselves with their own actions). And after the loss of the first deposit, and maybe even the second or third, it’s time for increased fear, a reduced desire to take risks and the saddest thing is disappointment in yourself as a trader, trading in general, accompanied by a loss of confidence in yourself and your actions in the market. This is what the pit of suffering looks like.

Many traders started their “career” as a trader in this place. But only after overcoming this gap, through constant training, collecting and analyzing your trading statistics, monitoring your condition and compliance with the rules, gradually regaining confidence in your trading, achieving even small, but regular, calculated, and not random victories, a trader becomes a professional. Be prepared for such a scenario and don’t be afraid of it. This path has been done by all the traders we know.

WHAT ELSE IS IMPORTANT TO UNDERSTAND?

- Unordered listThe market is a very fast environment

There is no need to wait for months to understand whether you have launched a successful business or not – your every action on the market is instantly expressed in financial results, profit or loss, whether you were right or not, leave an open trade or close. The score sometimes goes by seconds.

- The market is a very tough environment

There is no one here to whom you could shift the responsibility for your result. You are the only one responsible for everything that happens with your deposit, and you must be fully aware of and accept this responsibility. You are alone here.

- The market is absolutely neutral to everyone

and it is impossible to negotiate with it. The trader either understands him and goes with him, or not. Hence, there is a need for an important psychological property that must be possessed or cultivated in oneself – the ability to admit one’s wrongness as quickly as possible, to accept a loss as quickly as possible, not to reflect for a long time because of this (losses are an integral part of trading) and to continue trading calmly.

- In the market, everyone is for himself

There is no need in the market, and there is no opportunity to prove something to someone, here everyone is only for himself and against everyone. And the magnitude of success and intelligence is determined by a single quantitative indicator – how much money you have taken out of the market for today, for a month, for a year. You can take all the courses in the world of trading, know thousands of patterns, cover charts with all possible indicators and be “smarter” than everyone, but there is only one indicator – the absolute value of profit.

- In the market, you can lose any money

(both your own and borrowed). You can earn any money on the market.

- Trading is an environment with maximum competition

– every trader in the world is your competitor for profit.

- Trading is an environment with minimal competition

– the percentage of earning traders is 2.

- A sober look at yourself

The market and your behavior on it will tell you a lot and quickly about yourself. Which, in turn, with proper study, will allow you to become better not only in trading, but also in other areas of life.

- Trading is an activity that requires a lot of flexibility

Stubbornness, the desire to stand your ground is punishable here. “A branch that doesn’t bend breaks.” Stubbornness in trading is appropriate only with respect to compliance with the rules of risk management and following strategies. It will be necessary to be flexible not only in relation to their decisions about the trades being made at the moment, but also in looking at the market as a whole. The market is a living, constantly changing environment and it is important to notice the change of trends, mood, nature of movements and adapt to them.

- Age and trading

The earlier in your life you get inspired by this craft and start, the faster and more effective your formation as a trader will be. But this does not mean at all that there is some age after which it is too late - no, it is never too late if you have interest, motivation and discipline. Therefore…

- … not everyone’s path in trading will be easy – someone will lack patience, someone discipline, someone will be hindered by pride and thirst for self-righteousness. But if you have the will and motivation, you can and should work with all this, and in the end, no matter how difficult trading may seem, turn this type of earnings into the most profitable business of your life.